We provide investment banking, research, sales and trading, asset and wealth management, public finance, insurance, private capital, and family office services.

We are a family-owned financial services firm that values client relationships, long-term stability, and supporting the communities where we live and work.

The idea of family defines our culture, because each of us knows that our reputation is on the line as if our own name was on the door.

Our reputation as a leading independent financial services firm is built on the stability of our longstanding and highly experienced senior executives.

We are committed to corporate philanthropy; economic and financial literacy advocacy; and diversity, equity, and inclusion initiatives.

Stephens is proud to sponsor the PGA TOUR, LPGA Tour, and PGA TOUR Champions careers, as well as applaud the philanthropic endeavors, of our Brand Ambassadors.

We host many highly informative meetings each year with clients, industry decision makers, and thought leaders across the U.S. and in Europe.

We provide fiduciary investment strategies to public-and private-sector institutional clients through asset allocation, consulting, and retirement services.

Decades of proven performance and experience in providing tailored fixed income trading and underwriting services to major municipal and corporate issuers.

Proven industry-leading research, global market insights, and client-focused execution.

Customized risk management, property & casualty, executive strategies and employee benefits solutions that protect our clients over the long term.

We assist companies with accessing capital through innovative advisory and execution services that help firms achieve their strategic goals.

We have been a trusted and reliable source of capital for private companies for over 70 years.

Our experienced Private Client Group professionals develop customized investment strategies to help clients achieve their financial goals.

We are a trusted municipal advisor with proven expertise in public financings. We also work with clients in negotiated and competitive municipal underwritings.

Last week saw the second-largest bank failure in American history. In fact, the three banks that have failed so far this year had more assets under management than the 25 banks that went under at the onset of the Global Economic Crisis in 2008. Also last week we experienced a market sell-off, continued inflation, a Fed interest rate hike, and a government stand-off over the debt ceiling.

With all these events converging, many Americans are wondering if it’s time for the country to put its runaway spending in check. The United States, as I’ve outlined in my Viewpoint report back in January (and will again in my upcoming mid-year report), is facing a dismal decade ahead. Economic growth will be downright anemic at 1 to 2 percent a year, taxes could continue to skyrocket, and regulations could well become even more onerous and unrelenting. Worst of all is that America begins the coming decade saddled with $31.4 trillion in debt.

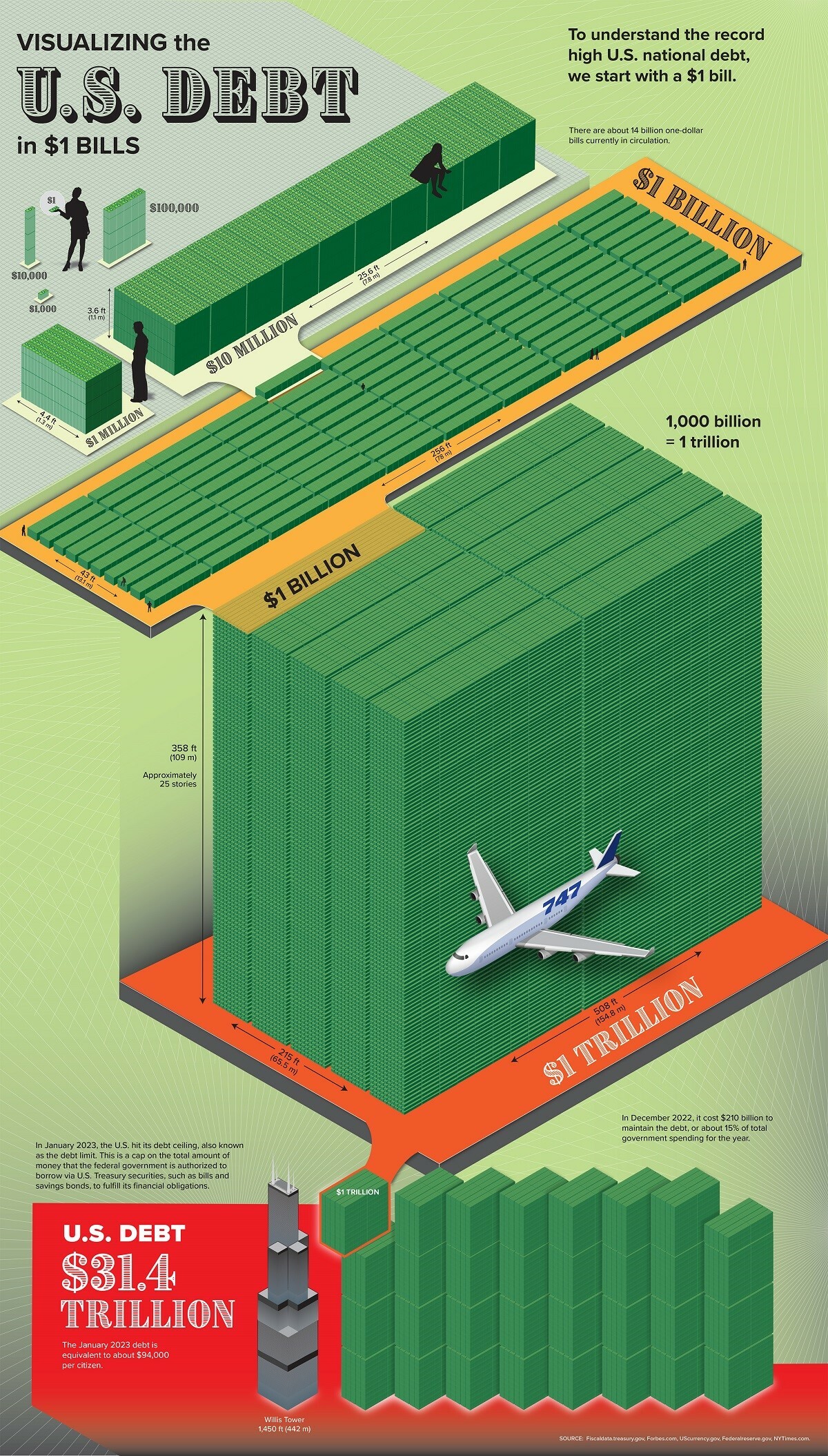

For an idea of just how much money this country owes the rest of the world, check out the illustration below. If 31 trillion one-dollar bills were stacked up side by side, they would take up the space of eight Willis Towers in Chicago. That’s a lot of cash.

To those who ask if America is going bankrupt and, if so, if there is any hope, I will provide a balanced perspective to the many events last week that portend more economic misery. In America we have this sense that governments in some way shouldn't be accumulating a lot of debt. We tend to think it’s money that we should take back as individuals to our own families, businesses, and investments. It’s not a bill we want to send to our grandchildren.

But the fact is that governments are somewhat different than individuals. Even corporations are different from individuals. Think about an airline, for instance. Over the long run, if it’s a successful company, it will have to buy more airplanes and build better terminals. A corporation might very well accumulate debt over a near-infinite time horizon with the expectation it's never going to be paid off.

This is a concept that carries over to governments. These entities essentially have the same kind of near-infinite life expectancy. And during that enormous time span, there’s always a need for the kinds of things that governments provide: new airports, highways, bridges, computer infrastructure, and provisions for national defense. It’s best not to liken the finances of governments to those of families. They're a different animal. Most economists think that governments can carry some reasonable debt load and that it’s not a problem as long as the economy remains productive over the long haul. That means the economy must continue to grow.

What politicians are debating in Washington this week includes this: When does the amount of debt a government carries become unreasonable? It depends on the size of the government and the relative size of the economy. The economists Kenneth Rogoff and Carmen Reinhart have done influential work on the topic during the last decade. A conclusion based on their empirical work is that a country limit its debt load when it approaches 90 percent of its GDP. Therefore a government with a $10 trillion economy can, without too much pain, accumulate up to $9 trillion of debt. Rogoff and Reinhart argued that if a government has debt north of 90 percent of its GDP, it begins to put an onus on the interest burden of the economy and is a negative factor for long-term growth.

Today in America we've passed that 90 percent threshold. Americans should be concerned about this fact. That kind of debt load is the last thing this country needs because we’re facing longer term growth rates somewhere under 2 percent. Looking to a 2030 to 2033 horizon, the best projections we have are that current government obligations could reach 110 percent of GDP, up from the current 92 percent. But being concerned doesn’t mean panicking and losing all hope for the future. Suppose the national debt reaches 110 percent of GDP. It doesn’t mean the country will go bankrupt. What will happen is that we will have to pay a higher rate of interest on future debt offerings.

Foreign Creditors

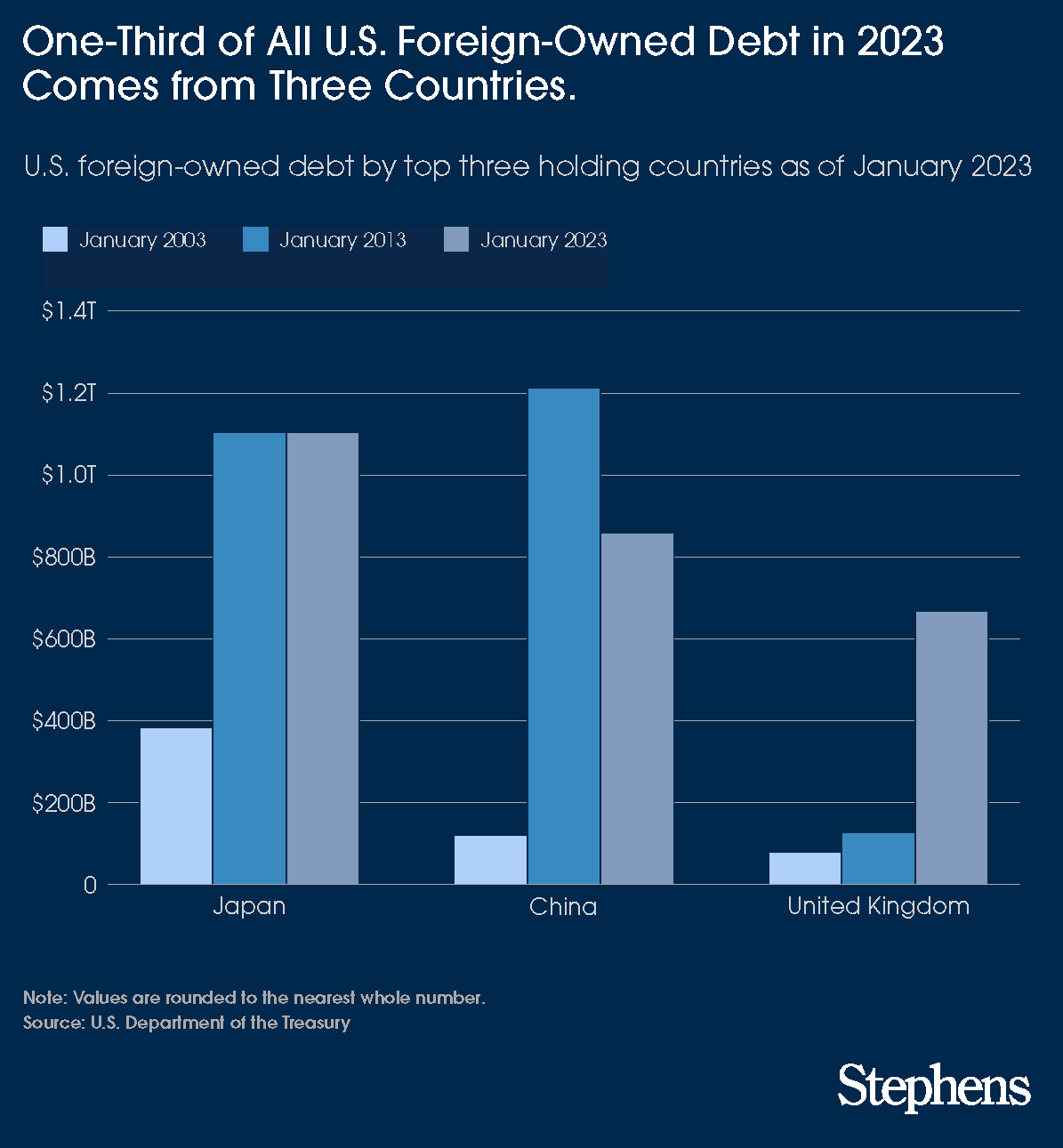

Speaking of panic, I do get the sense that many people are alarmed by who owns the massive amount of debt of this country. The portion of the debt that’s owned by Americans provides some measure of comfort. The interest payments are being made back to our financial institutions and back to us as individuals. Where you begin to see a problem is the substantial amount of debt owned by entities outside of the United States.

Sadly, China owns a significant chunk of this country. To be sure, allies like the United Kingdom and Japan are also significant debt-holders. When those interest payments on that debt are paid abroad in dollars, the outflow has the potential to weaken our currency and set off a chain reaction of associated problems. As a comparison, Japan has a huge governmental debt—over 200 percent of its GDP. But virtually all of it is owned domestically.

What irks people the most, however, isn’t a foreign creditor. It’s when a government accumulates vast amounts of debt but fails to build a strong economic backbone for its people. You need to ask yourself this: Can you see palpable evidence that the debt that America is accumulating is worth it? Are America’s government agencies, rail networks, computer infrastructure, and national defense delivering what Americans expect to be happening in those areas?

Much of it looks bleak to me. Part of the computer infrastructure at the U.S. Treasury, for instance, is a half-century old. The interstate highway system is in shambles. Certain parts of the Pentagon continue to use floppy discs. Attempting to reach a human being at a federal agency like the IRS is virtually impossible. And some of the airports I fly into resemble those of third-world countries.

The disconnect between the amount of debt the country is accumulating and what we get for it is astounding. Add to this crisis the fact that a regime like China is a major creditor—and it has no intention of allowing America to get out of paying what it owes them.

Thomas Goho, Ph.D. is formerly the Chief Economic Consultant for Stephens Inc. He also served as the Co-Director of Stephens University at Wake Forest University.