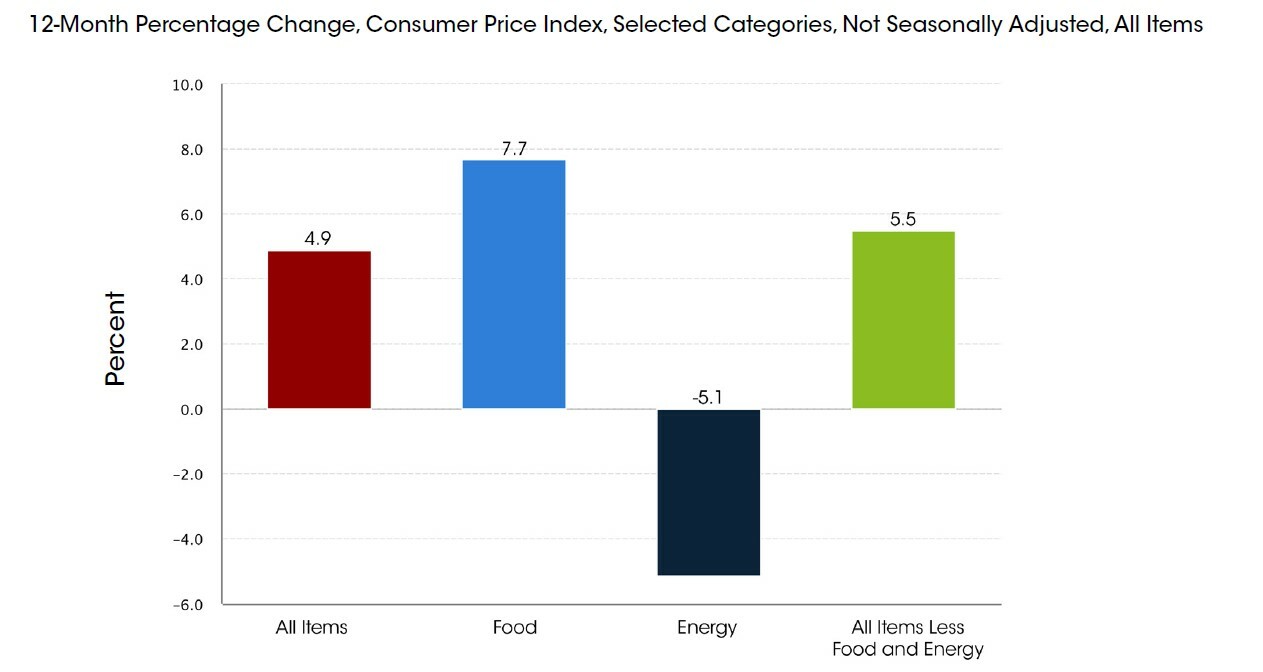

The Consumer Price Index (CPI), which measures changes in prices paid by consumers for goods and services, was released earlier today for the month of April and showed a 0.4% month-over-month (m/m) increase and +4.9% year-over-year (y/y) vs. the prior month of +0.1% m/m (m/m) and +5.0 (y/y). The April data showed an increase in Shelter expense by +0.4% m/m followed by Used Cars and an increase in Gasoline. April’s y/y increase of +4.9% was the lowest level in the past two years.

Source: Consumer Price Index (bls.gov)

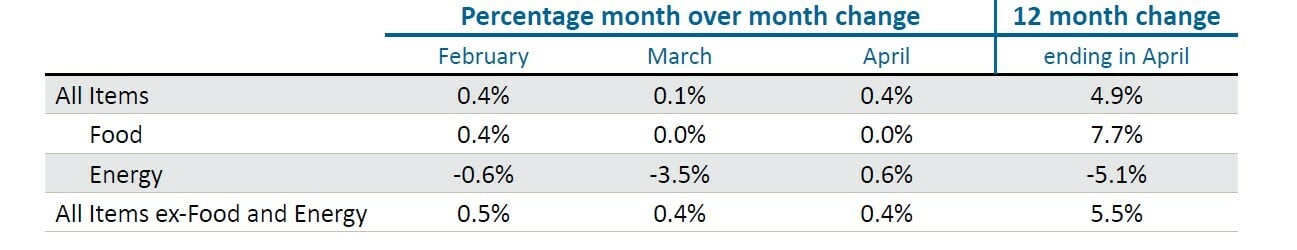

The table below shows m/m percentage changes in CPI indexes across All Items, Food and Energy in addition to the Core CPI, which excludes Food and Energy.

Source: Consumer Price Index (bls.gov)

One of the two major focuses of the Federal Open Market Committee (FOMC) is price stability, which is running well above the target range of 2%. Per the Federal Reserve’s May 3 news release, members reemphasized their commitment to using the tools at their disposal to try and tackle inflation. The next decision regarding fed fund rates will be announced on June 13-14. The May CPI summary is scheduled for release on June 13.

Disclosures

- The information in the accompanying report has been prepared solely for informative purposes and is not a solicitation, or an offer, to buy, sell or hold any security or a recommendation of the services supplied by any money management organization. It does not purport to be a complete description of the securities, markets or developments referred to in the report. We believe the sources to be reliable, however, the accuracy and completeness of the information is not guaranteed. We, or our officers and directors, may from time to time have a long or short position in the securities mentioned and may sell or buy such securities. Data displayed on this site or printed in such reports may be provided by third party providers. The indexes referenced in the charts presented are unmanaged and do not reflect any transaction costs or management fees. They were chosen to give you a basis of comparison for market segment performance. Actual investment alternatives may invest in some instruments not eligible for inclusion in such an index or model and may be prohibited from investing in some instruments included in such an index or model. This document is intended only for the addressee and may not be reproduced or redistributed. If the reader is not the intended recipient, you are notified that any disclosure, distribution or copying is prohibited. Additional information is available upon request. Please contact your Financial Consultant with any questions.