We provide investment banking, research, sales and trading, asset and wealth management, public finance, insurance, private capital, and family office services.

We are a family-owned financial services firm that values client relationships, long-term stability, and supporting the communities where we live and work.

The idea of family defines our culture, because each of us knows that our reputation is on the line as if our own name was on the door.

Our reputation as a leading independent financial services firm is built on the stability of our longstanding and highly experienced senior executives.

We are committed to corporate philanthropy; economic and financial literacy advocacy; and diversity, equity, and inclusion initiatives.

Stephens is proud to sponsor the PGA TOUR, LPGA Tour, and PGA TOUR Champions careers, as well as applaud the philanthropic endeavors, of our Brand Ambassadors.

We host many highly informative meetings each year with clients, industry decision makers, and thought leaders across the U.S. and in Europe.

We provide fiduciary investment strategies to public-and private-sector institutional clients through asset allocation, consulting, and retirement services.

Decades of proven performance and experience in providing tailored fixed income trading and underwriting services to major municipal and corporate issuers.

Proven industry-leading research, global market insights, and client-focused execution.

Customized risk management, property & casualty, executive strategies and employee benefits solutions that protect our clients over the long term.

We assist companies with accessing capital through innovative advisory and execution services that help firms achieve their strategic goals.

We have been a trusted and reliable source of capital for private companies for over 70 years.

Our experienced Private Client Group professionals develop customized investment strategies to help clients achieve their financial goals.

We are a trusted municipal advisor with proven expertise in public financings. We also work with clients in negotiated and competitive municipal underwritings.

With interest rates at historic lows, many Arkansas school districts have refinanced or “refunded” their outstanding municipal bonds to reduce their interest costs. In fact, Arkansas school districts represented by Stephens saved more than $41 million during 2020 by refunding their outstanding bonds.

When issuing bonds, a district enters into an agreement with investors agreeing to pay them principal and interest for a specified period before having the option to “call” bonds away from those investors prior to maturity. While each bond transaction is unique, many municipal bonds carry an optional redemption or “call date” of approximately 5 to 10 years. The industry standard is 10 years for this investor protection.

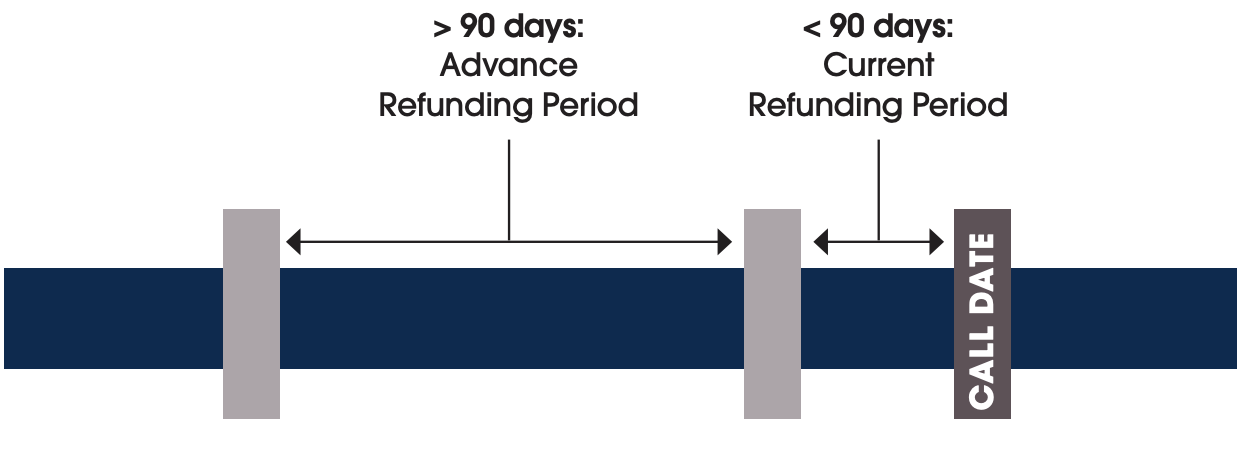

A “refunding” is a bond financing procedure whereby a district may pay off or “redeem” all or certain maturities of existing debt by issuing new bonds. In general, there two types of refundings defined in the tax code: (1) a current refunding and (2) an advance refunding, which are determined by the optional call date.

A current refunding is a transaction in which a district pays

off the existing bonds within 90 days of issuing the new

bonds. Depending on the district’s needs, it may use either

tax-exempt or taxable bonds to current refund a bond issue.

An advance refunding is a transaction in which the payoff of the outstanding bonds is more than 90 days from the date of issuing the new refunding bonds.

Changes to federal tax law in late 2017 eliminated the ability of districts to issue tax-exempt advance refunding bonds. However, a district may use taxable bonds to refund its outstanding bond ahead of the optional call date if it makes economic sense. To do so, a district will be required to establish an escrow account to pay investors until the agreed upon call date on the original bond issue.

Districts should consider the following when evaluating whether to refund their outstanding municipal bonds and discuss their financing objectives with their municipal advisor. These considerations include:

When a district issues bonds, it enters into an agreement with investors, and in most instances, establishes a fixed optional call date. Meaning, the district agrees to pay the investors principal and interest for a designated period before having the “option” to pay off its outstanding bonds earlier than the stated maturity. Investors view this as a type of investment protection.

A district must consider when the outstanding bonds are callable. If not callable, the district will not be able to conduct a tax-exempt refunding and should explore whether it is economically advantageous to advance refund the bonds prior to the call with taxable bonds. For example, if a district issued bonds in 2019 and assigned a 5-year optional call date, the district will be restricted from issuing tax-exempt bonds until 2024.

Please keep in mind that while investors tend to prefer longer call periods, a district can set the optional call date as short as it desires. The tradeoff is that the shorter the call period, arguably, the higher the interest rate as investor will expect to be compensated for the potential loss in yield. A district should work with its municipal advisor to determine the cost/ benefit of when the optional call date should be set.

Most frequently, districts will refund their outstanding bonds to lower the interest rate and achieve cash flow savings. Thus, achieving an increased annual cash flow.

In determining whether to refund an outstanding bond issue, a district may consider establishing a minimum net savings threshold that factors in the costs of a refinancing. For example, this threshold could be a fixed percent such as 3% for current refunding and 5% for an advance refunding. Arkansas’s Division of Elementary and Secondary Education (DESE) regulations correspond with this guidance by requiring a district to generate a minimum principal and interestsavings of at least one hundred thousand dollars ($100,000) or five percent (5%) of total principal and interest over the life of the bond on the refunded (old) issue.

Another consideration is whether the district has multiple bond issues outstanding with the same security and maturity date. If so, the district may consider whether it makes economic sense to combine these transactions into one bondoffering in order save on the costs of issuing the bonds. Moreover, a district should consult their advisor on how to best structure the expected cash flow savings in order to meet its needs.

In Arkansas, a refunding for debt service savings does not require a vote, but does need approval from DESE.

As noted, a district may use taxable bonds to refund outstanding debt when the optional call date is more than 90 days from the date of the closing. To do this, a district is required to establish an escrow account to pay investors principal and interest to the already established optional call date. The escrow costs are foregone savings. As such, the district needs to evaluate with its advisor whether the realized cash flow savings offsets escrow costs.

Districts need a partner who will not only watch the market for money-saving opportunities as interest rates change, but also advise them on the cost/ benefits of such transactions.

If you would like to learn more about these types of opportunities, please contact a Stephens Public Finance representative today.

For more information about our work with Arkansas school districts, please visit stephenspublicfinance.com.