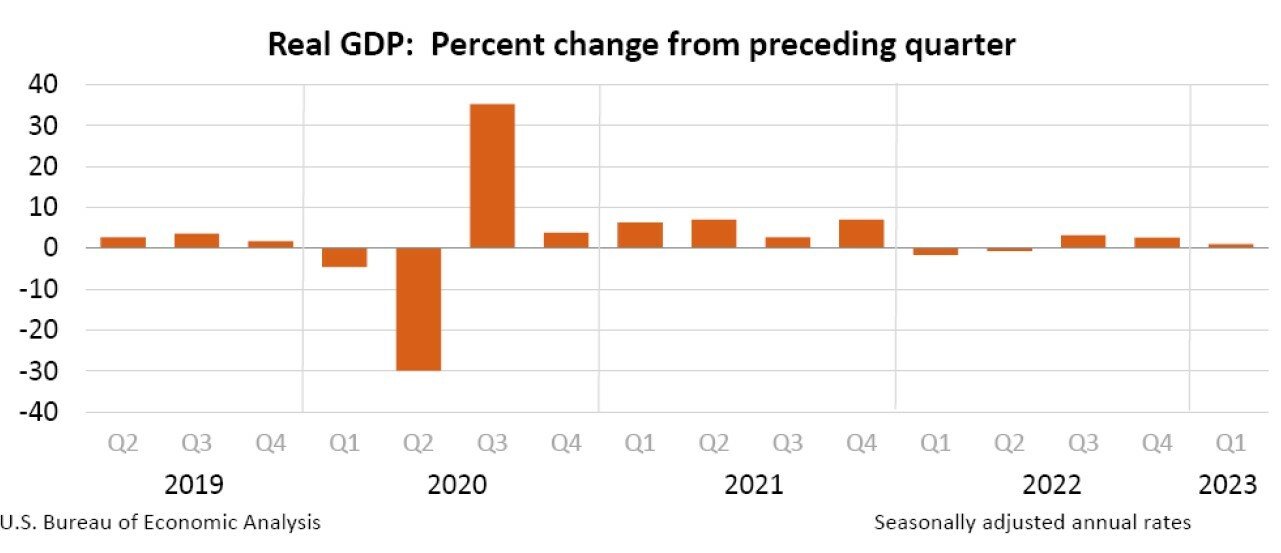

The Bureau of Economics Analysis (BEA) released its initial reading of the Q1 2023 Gross Domestic Product (GDP) this morning and reported the economy expanded by 1.1% from the prior quarter and 1.6% year-over-year (y/y). Q1 GDP was positive for the third consecutive quarter but showed a deceleration in the rate of growth. The chart below shows GDP growth over the previous quarter going back to Q2 2019.

Details from the release point to increases in Consumer Spending, Nonresidential Fixed Investment and Government Spending at the federal, state and local levels. Personal Consumption, which makes up more than two-thirds of the GDP, saw a rise of 3.7% from the prior quarter and a y/y increase of 2.48%. Services increased 1.03% y/y while Goods increased 1.45% y/y. Healthcare was one of the main drivers behind Services growth increasing 0.60% y/y.

This data is subject to revisions as more data becomes available. The second reading of Q4 GDP will be released May 25.

Disclosures

- The information in the accompanying report has been prepared solely for informative purposes and is not a solicitation, or an offer, to buy, sell or hold any security or a recommendation of the services supplied by any money management organization. It does not purport to be a complete description of the securities, markets or developments referred to in the report. We believe the sources to be reliable, however, the accuracy and completeness of the information is not guaranteed. We, or our officers and directors, may from time to time have a long or short position in the securities mentioned and may sell or buy such securities. Data displayed on this site or printed in such reports may be provided by third party providers. The indexes referenced in the charts presented are unmanaged and do not reflect any transaction costs or management fees. They were chosen to give you a basis of comparison for market segment performance. Actual investment alternatives may invest in some instruments not eligible for inclusion in such an index or model and may be prohibited from investing in some instruments included in such an index or model. This document is intended only for the addressee and may not be reproduced or redistributed. If the reader is not the intended recipient, you are notified that any disclosure, distribution or copying is prohibited. Additional information is available upon request. Please contact your Financial Consultant with any questions.