We provide investment banking, research, sales and trading, asset and wealth management, public finance, insurance, private capital, and family office services.

We are a family-owned financial services firm that values client relationships, long-term stability, and supporting the communities where we live and work.

The idea of family defines our culture, because each of us knows that our reputation is on the line as if our own name was on the door.

Our reputation as a leading independent financial services firm is built on the stability of our longstanding and highly experienced senior executives.

We are committed to corporate philanthropy; economic and financial literacy advocacy; and diversity, equity, and inclusion initiatives.

Stephens is proud to sponsor the PGA TOUR, LPGA Tour, and PGA TOUR Champions careers, as well as applaud the philanthropic endeavors, of our Brand Ambassadors.

We host many highly informative meetings each year with clients, industry decision makers, and thought leaders across the U.S. and in Europe.

We provide fiduciary investment strategies to public-and private-sector institutional clients through asset allocation, consulting, and retirement services.

Decades of proven performance and experience in providing tailored fixed income trading and underwriting services to major municipal and corporate issuers.

Proven industry-leading research, global market insights, and client-focused execution.

Customized risk management, property & casualty, executive strategies and employee benefits solutions that protect our clients over the long term.

We assist companies with accessing capital through innovative advisory and execution services that help firms achieve their strategic goals.

We have been a trusted and reliable source of capital for private companies for over 70 years.

Our experienced Private Client Group professionals develop customized investment strategies to help clients achieve their financial goals.

We are a trusted municipal advisor with proven expertise in public financings. We also work with clients in negotiated and competitive municipal underwritings.

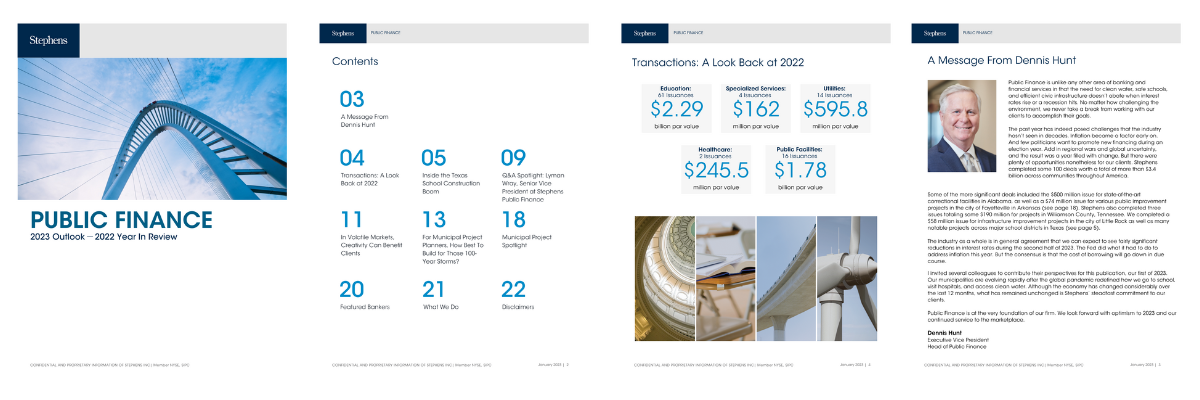

Public Finance is unlike any other area of banking and financial services in that the need for clean water, safe schools, and efficient civic infrastructure doesn’t abate when interest rates rise or a recession hits. No matter how challenging the environment, we never take a break from working with our clients to accomplish their goals.

The past year has indeed posed challenges that the industry hasn’t seen in decades. Inflation became a factor early on. And few politicians want to promote new financing during an election year. Add in regional wars and global uncertainty, and the result was a year filled with change. But there were plenty of opportunities nonetheless for our clients. Stephens completed some 100 deals worth a total of more than $3.4 billion across communities throughout America.

Some of the more significant deals included the $500 million issue for state-of-the-art correctional facilities in Alabama, as well as a $74 million issue for various public improvement projects in the city of Fayetteville in Arkansas (see page 18). Stephens also completed three issues totaling some $190 million for projects in Williamson County, Tennessee. We completed a $58 million issue for infrastructure improvement projects in the city of Little Rock as well as many notable projects across major school districts in Texas (see page 5).

The industry as a whole is in general agreement that we can expect to see fairly significant reductions in interest rates during the second half of 2023. The Fed did what it had to do to address inflation this year. But the consensus is that the cost of borrowing will go down in due course.

I invited several colleagues to contribute their perspectives for this publication, our first of 2023. Our municipalities are evolving rapidly after the global pandemic redefined how we go to school, visit hospitals, and access clean water. Although the economy has changed considerably over the last 12 months, what has remained unchanged is Stephens’ steadfast commitment to our clients.

Public Finance is at the very foundation of our firm. We look forward with optimism to 2023 and our continued service to the marketplace.

Dennis Hunt

Executive Vice President

Head of Public Finance

A Year Filled with Change, But Also a Lot of Opportunities: Stephens completed some 100 deals worth a total of more than $3.4 billion across communities throughout America.

Interest Rates Won’t Rise Forever: The Fed did what it had to do to address inflation this year. But the consensus is that the cost of borrowing will go down in due course.

Schools in Texas are Expanding: We’re helping school districts across Texas build and renovate facilities to address the influx of new students to the state.

Our Largest Bond Transaction Ever: $500 million for the construction of two state-of-the-art correctional facilities in Alabama.

Mitigating Volatile Markets for Clients: Cinderella bonds are initially issued on a taxable basis that later converts (like Cinderella at midnight) to a tax-exempt structure when the conditions for tax-exempt status are met (i.e., reaching the 90-day window for a tax-exempt current refunding).