Inflation and the recent downward trend in the U.S. economy are causing pain across all sectors of the country — from Wall Street to Walmart to wallets of consumers. Inflation is far higher than the rate expected by most economists just six months ago, and it’s compounding the economic difficulties that had already been inflicted by Covid and war-related supply disruptions. The United States may have entered a period of very slow or possibly negative growth for 2022.

This year has many similarities to the late 1970s when the United States experienced high inflation and slow growth. In the 1970s the Vietnam War was winding down, while oil-producing countries were declaring an economic war on the price and supply of oil. Now war is raging in Eastern Europe contributing to the disruption of key raw material markets. And the rising price of oil and gas has added to the woes of the economy.

In 2021, inflation was already unacceptably high, but Jerome Powell, chairman of the Federal Reserve, its Board members, Treasury Secretary Janet Yellen and others told us not to worry. They insisted that the inflation we were experiencing was transitory. In addition, 2021 economic growth was a robust 5.7% producing strong labor markets with low unemployment. Much has changed.

This issue of Viewpoint focuses not only on inflation but also on U.S. economic changes in recent months and the magnitude of the problems endemic to the U.S. economy. Questions we will discuss are:

- How large is the recent change in economic growth, and what are growth expectations for the next several quarters?

- Is a recession coming?

- Will labor markets continue to provide robust conditions for job seekers if the economy weakens?

- How serious are inflationary conditions and what will be the catalysts for any improvement?

- What, if anything, can the Federal Reserve and its monetary policies do to control inflation without too much damage to the economy?

In these times of massive uncertainty, answers to these questions will be highly provisional, like they were in early 2020 during the early days of COVID. Like 2020, the current issues are hard to quantify.

Economic Growth

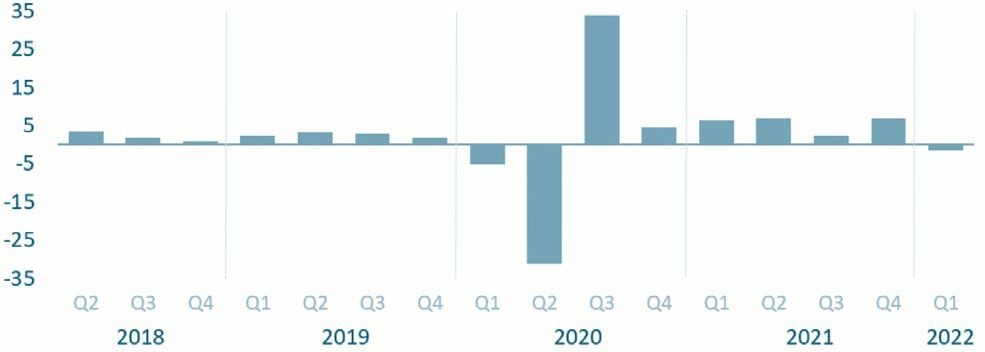

The economic recovery after Covid provides testimony to the resilience of the U.S. economy. After the economic paroxysms of the past two years, the economy ended 2021 with economic growth of 5.7% including growth in the fourth quarter of over 6%. Although there were supply-chain problems in 2021, the U.S. GDP rebounded and surpassed that of 2019. This recovery indicated that the U.S. economy was back on its normal growth trajectory. However, first quarter 2022 created a new worry for economists and politicians. Negative growth of 1.4% was reported by the U.S. Bureau of Economic Analysis. (See Figure 1.)

Figure 1: Real Gross Domestic Product, Percent Change from the Previous Quarter (2018 to Present).

Compared to the 2% growth that was achieved in the decade starting in 2010, American economic growth since 2019 was very erratic but still creditable. Now, growth has decelerated significantly since the start of the war in Ukraine in 2022. The negative growth in the first quarter of 2022 is stark evidence of that fact.

The negative growth in the first quarter of 2022 and possibly in the second quarter is evidence of the massive dislocations that are occurring in many sectors including energy and other raw materials.

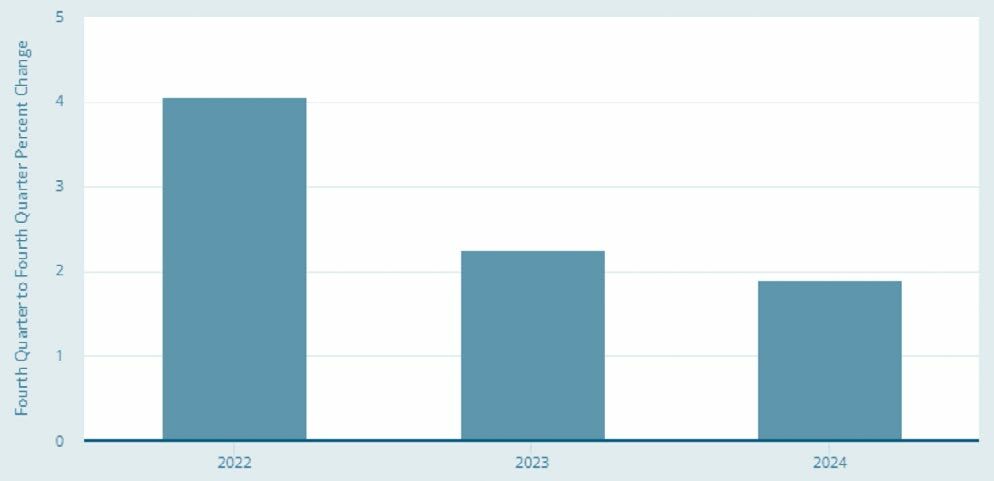

Early 2022 was shaping up to be another year of healthy growth after the turmoil of the Covid pandemic. The Federal Open Market Committee (FOMC) of the Federal Reserve thought it clearly saw the future when it made longer-term forecasts at the end of 2021. (See Figure 2.). It expected a healthy 4% growth in 2022 with growth subsequently trending downward to a long-run rate of about 2% starting in 2024.

Figure 2: Federal Open Market Committee’s (FOMC) Projections for the Growth of Real Gross Domestic Product (Real GDP), 2022 to 2024.

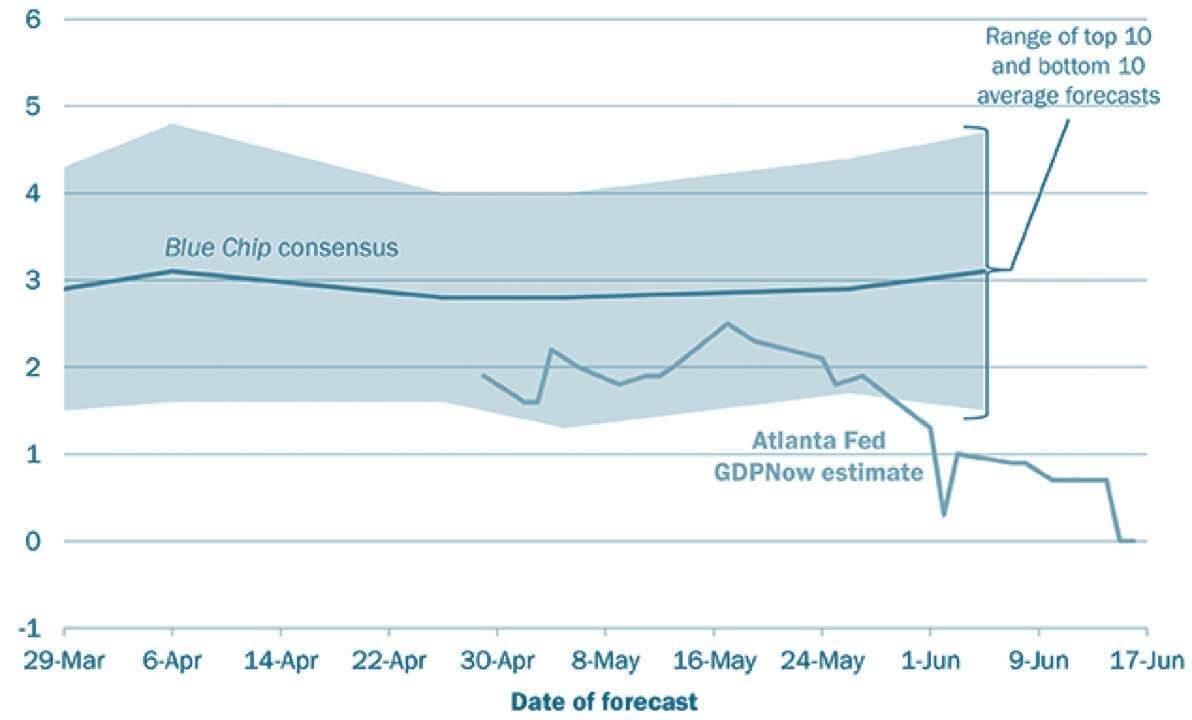

The war in the Ukraine has thrown the American economy (and Fed forecasting) into disarray. The most recent forecasts of the Federal Reserve Bank of Atlanta suggests that second quarter real GDP growth is likely to be about zero. (See Figure 3.)

Figure 3: Atlanta Federal Reserve Forecast of Second Quarter 2022 Real GDP, Quarterly Percent Change.

Other forecasters are beginning to downgrade their growth forecasts for the remainder of 2022 and into 2023. The Federal Reserve of Philadelphia’s survey of 36 professional economists summarizes these individual forecasts. (See Figure 4.) Downgrades to growth are anticipated for the remainder of the year and into 2023. Even these forecasts should be taken with a grain of salt.

Figure 4: Forecasts of Quarterly Real Gross Product Growth for 2022 and 2023 by 36 Professional Forecasters.

In February 2022, these forecasters thought that first quarter real GDP would be 1.8% when it turned out to be minus 1.4%. That is a miss of 3.2%: not very impressive forecasting. These results highlight the difficulty of economic forecasting in this current unsettled environment.

Best Guess About Economic Growth

As the impact of Covid receded from the economy, the economic life of the United States and the world seemed to be returning to normal. A growth rate of 3% seemed almost a sure bet, even with unacceptable inflation. Now with the Ukraine war and intermittent Covid outbreaks, growth will be very low with a distinct possibility of a recession in the next 18 months. Most forecasters place a low probability of a recession in 2022 with the risk of a recession in 2023 of about 50%. Given the current supply disruptions and shortages of labor across many industries, we are even more pessimistic. We think a recession in the next 12 to 18 months is almost a certainty.

Labor Markets and Employment

While growth weakens, labor markets remain strong. The unemployment rate is at or near a multi-decade low at 3.6%, only slightly above the rate of 3.4% recorded prior to Covid. (See Figure 5.)

Figure 5: Unemployment Rate, 2000 to Present. (Seasonally Adjusted).

Employment has rebounded significantly since the effects of Covid have moderated. (See Figure 6.) The strong unemployment situation carries across almost all demographic groups. The unemployment rate for Hispanics is 4.2% and Blacks 6.2%.

Figure 6: Overall Unemployment Rate (solid line), Black Rate (dotted line) and Hispanics Rate (dash line), 2000 to Present).

A group that is missing from the strong employment picture are prime-age workers. Historically, prime-working age Americans were working in large numbers. Now they are doing something else. Labor economists are not sure what that something else is or why.

A key metric of total employment, the labor participation, is weak with only 62.2% of prime working age workers in the labor force. This withdrawal from the workforce has huge negative implications for future growth. The United States is suffering from a shortage of these prime working-age workers. There are a record 11 million job openings with only 6.0 million currently unemployed people.

Best Guess About Employment and Unemployment

Most measures of employment and other conditions of the labor market suggest that employment opportunities are quite favorable for available workers. However, the economy seems to be cooling very quickly — faster than most economists were forecasting even three months ago. The unemployment rate is likely to edge upward toward 4.0% by year-end from the current rate of 3.6%. If growth remains negative for several more quarters, we expect unemployment to exceed 4.5% — not an employment disaster but certainly a problem for unprepared households (and politicians in an election year). Yet, American workers are in a relatively strong position to withstand a possible economic downturn.

Inflation

All economic data are now showing a rapid increase in inflation. In less than two years inflation has increased from a modest rate of 1.5% to about 8.6%. Excluding the volatile food and energy price components of the Consumer Price Index (core CPI) inflation is still 6%. (See Figure 7.) As recently as November 2021, Treasury Secretary Janet Yellen said she expected core inflation of between 2.5% and 3.6% by the second half of 2022. The American economy and the Ukrainian war have impinged on her prediction.

Figure 7: Core Consumer Price Index (CPI), excluding food and energy.

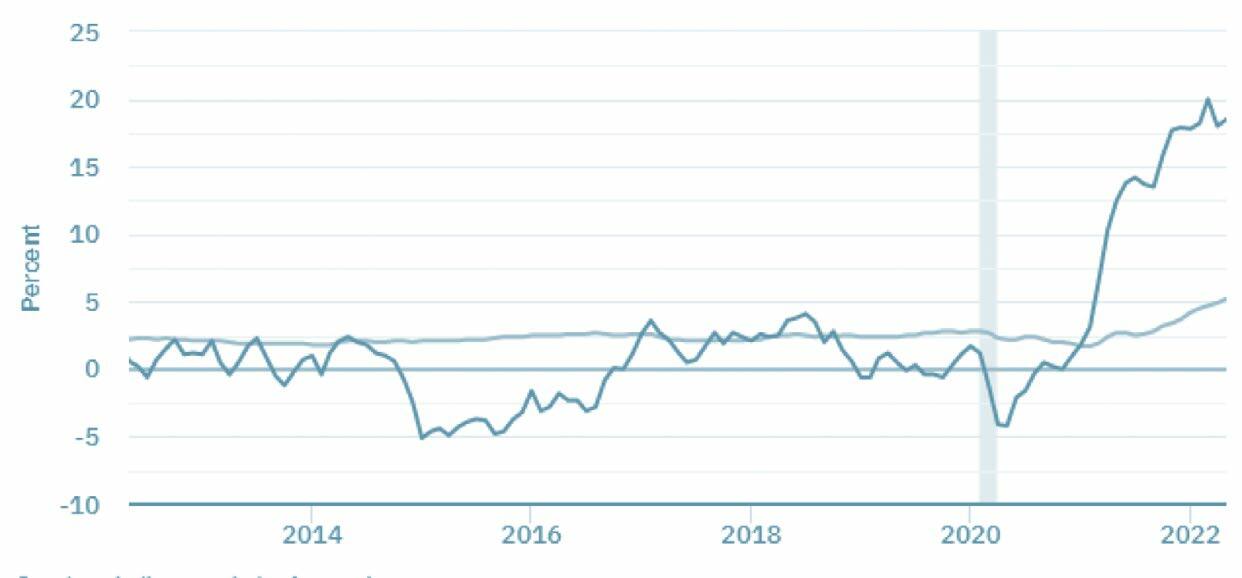

In early 2021 consumer prices were well behaved. Both sticky (slowly changing) and flexible (rapidly changing) consumer prices were increasing at an annual rate of slightly under 2%. By the end of the first quarter of 2022, sticky prices on consumer goods and services (including food and energy) were increasing at an annual rate of 4.7% compared to the beginning of 2021 when these prices were up 1.8%. On the other hand, flexible prices in the consumer price index had increased in the early 2021 at annual rate of 1.7% and are now up 18.5% in the last 12 months. (See Figure 8.)

Figure 8: Sticky versus Flexible CPI Measures, 2012 to Present (dark line indicates flexible prices and light line indicates sticky prices).

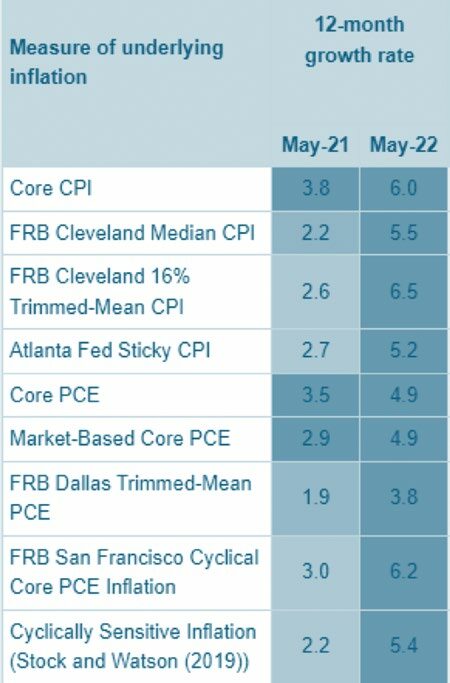

Several Federal Reserve branch banks have developed their own measures of inflation. The details of these measures are complex, but the essence of all Federal Reserve Bank measures indicate that the inflation has about doubled in 12 months from early 2021 to early 2022. (See Figure 9.)

Figure 9: Several Measures of Recent Underlying Inflation for 2021-22.

Participants in the Treasury bond market are now betting that the average rate of inflation over the next 5 years will average about 3.0%, more than twice the expected rate before the onset on the Covid pandemic. This 3.0% rate is still far below the current inflation rate measured in mid-2022. (See Figure 10.)

Figure 10: 5-Year Breakeven Inflation 2018 to Present

Best Guess About Inflation

At least two factors will shape the course of America’s inflation over the coming year or years. First, the length of the Ukrainian war. If the war continues unabated and trade in critical global resources like energy, agricultural products and critical metals is restricted from Russia and the Ukraine, then inflation will continue to be elevated for at least the next 12 to 24 months. The second factor is Federal Reserve monetary policy, which possesses no magic bullet for this inflationary morass.

The bottom line is that core inflation will persist far above the Fed’s target rate of 2% for the next 12 to 24 months with 4% to 5% as a responsible guesstimate for that period.

Federal Reserve and Monetary Policy

In normal times markets expect the Federal Reserve to confront the rapid increase in inflation with strong and decisive action. The Fed normally begins to raise short-term interest rates with a measured strategy. It begins to sell assets to facilitate the shrinking of the money supply and thereby slow the rate of expected growth and potential inflationary pressures in the economy.

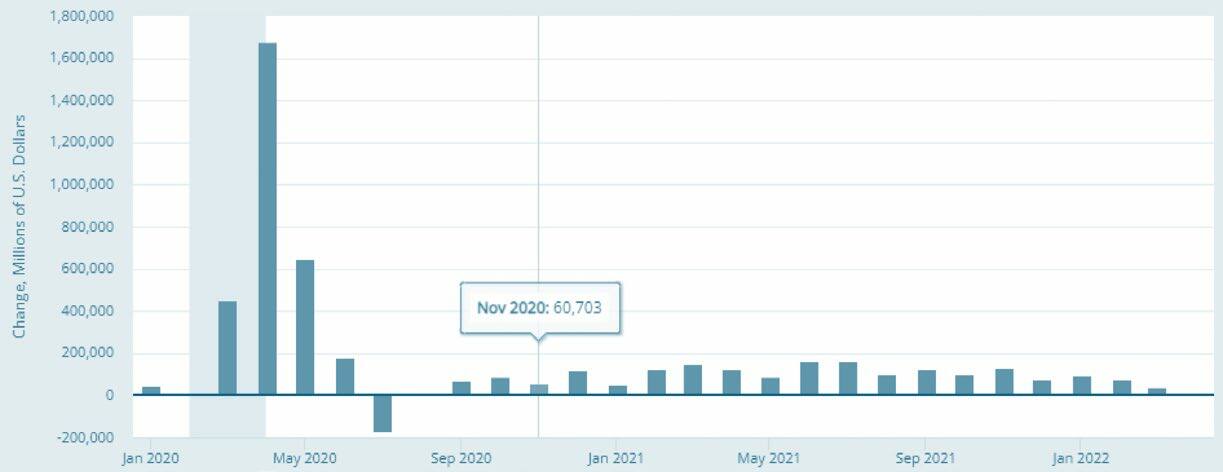

The current Federal Open Market Committee has been slow to adjust monetary policy. (See Figure 11.) The Fed maintained its purchases of Treasury bonds and mortgage-backed securities through April 2022. Its balance sheet continued to grow, not shrink.

Figure 11: Monthly Changes in the Size of the Federal Reserve Banks Balance Sheet, 2020 to Present.

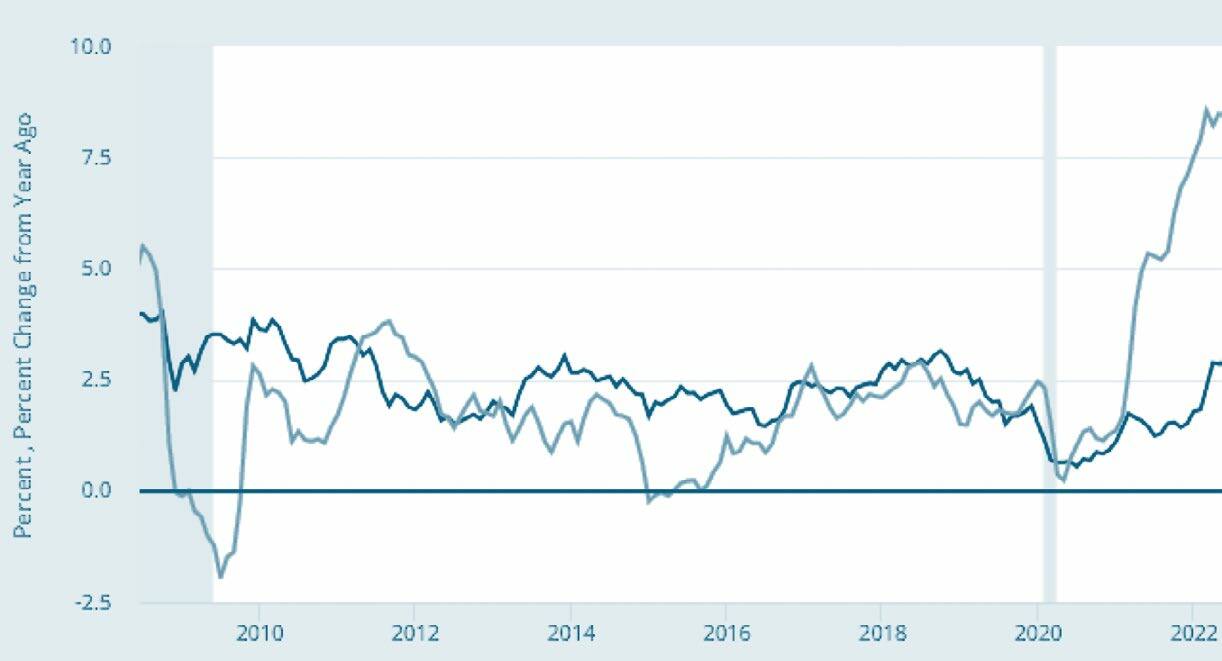

The almost endless purchase of Treasury debt and mortgage-backed securities for the last decade has produced an untenable situation. The real yield, which is the return on Treasury bonds after subtracting the rate of inflation, is about minus 5.5% (3.1% yield on 10-year Treasuries minus the rate of inflation of 8.6%). Because of the significant purchases of bonds by the Fed, interest rates were and are artificially low, which cannot persist over the long run especially as inflation remains elevated. (See Figure 12.)

Figure 12: Market Yield on 10-Year Treasury Bonds (dash line) versus The Consumer Price Index (CPI) (solid line), 2008 to Present.

On March 16, 2022, the Fed and its policy making group, the Federal Open Market Committee (FOMC), finally decided that inflation was not transitory. In an expected move, the FOMC announced that it would immediately raise the short-term rate by one-quarter of a percent. In addition, on May 4th it announced a one-half percent increase in its target interest rate with the prospects of several subsequent monthly increases of .5%.

Additionally, Chairman Powell and the FOMC announced that they would finally begin to shrink the size of the Treasury’s balance sheet. It will reduce its holding of Treasury bonds and mortgage-backed securities by $47.5 billion per month until September 2022 followed by the reduction in assets of $95 billion per month starting in September 2022.

After the June 15th meeting of the FOMC, Chairman Powell announced that the Fed would increase its target interest rate by an additional .75%, instead of the .50% increase that it signaled 3 months before.

Best Guess About Monetary Policy

The Fed’s recent announcements are hardly draconian given the severity of the inflation problem. Supply-chain problems starting during Covid shutdowns and shortages due to the war in Ukraine are unlikely to ease soon. We, at Stephens, think the Federal Reserve and its FOMC are not true believers in aggressive measures to correct problems caused by their own actions.

We expect that the Fed is and will be very cautious as it charts the course to bring inflation under control. It will likely be less rather than more aggressive in fighting inflation, hoping that unknowable forces will aid in the battle against inflation for which it is largely culpable.

The Fed forecasts that the rate of core inflation will quickly improve with the rate falling this year to 4.3%, down to 2.7% in 2023, and to 2.3% in 2024. With such optimistic inflation forecasts, we expect the Fed will take a cautious approach to fixing the inflation problem. This caution is surely a mistake that will produce inflation above the Fed’s 2% inflation target.

Final Thoughts

Six months ago, when we wrote the last Viewpoint, before the disruptive impact of the Ukrainian war, we expected low growth and strong labor markets along with unacceptably high inflation.

During the last 6 months, these predictions were largely on target. However, the war in the Ukraine, with its economic disruptions, now suggest that economic conditions are rapidly moving in the wrong direction. The odds of a recession have increased to close to 100% within the next 12 to 18 months.

The economic ball is in the Federal Reserve court, and it is not clear that the Fed is ready for aggressive monetary policy. It has been slow to counteract its mistakes. These missteps in the last decade include:

- Failure to reduce the size of its balance sheet after the financial crisis of 2008 and 2009 when economic conditions were slowly returning to normal.

- Again, over-expanding its money supply growth during the pandemic of 2020 and 2021 to accommodate massive spending by the U.S. government, purchasing over 50% of all new government debt.

- Announcing the Fed would tolerate inflation above 2%, its putative upper bound on inflation.

- When the Fed’s inflation far exceeded its target of rate of 2%, asserting that these higher prices were only “transitory.”

Now the Fed is assessing the inflation problem through the lens of slowing growth and is erring on the side of too much caution. It’s unfortunate, but high inflation requires stern action not half measures. In the 1980s, Fed chairman Paul Volker understood the problem and acted to arrest runaway inflation. And it did cause a recession in 1981-82, an unavoidable consequence of stemming inflation.

Panicos Demetriades, a former European Central Bank policy maker, summed up the problem facing the Fed and other major central banks. “Central banks need to act on inflation, [then] what do they do [about] the slowdown? This is a poisoned chalice. They can’t do both.” The Fed’s recent rate decisions suggest that it will do less, not more, fearing that it will be blamed for a recession by politicians inside the Beltway.

Current economic predictions are always fraught with uncertainty. The next 12 months will be especially uncertain. What’s in store for American workers and households?

- Growth: little or no growth for the next several quarters, then the likely start of a recession in 2023.

- Inflation: a continuing problem with the rate slowing in late 2022 and into 2023, but still far above the Fed target of 2%.

- Employment: solid labor markets but weakening into 2023. Three issues, at least, complicate our predictions.

- The war in Ukraine: Will the war expand, continue unchanged, or come to some negotiated end? The answer has huge implications for the supply of energy, food stuffs and critical minerals destined for world markets.

- Covid: Will a new variant of Covid appear and again disrupt normal economic activity in the U.S. and globally? Past variants have caused significant contractions in business activity.

- Recession: If a recession does materialize in the U.S., will Congress again pass a large stimulus to counteract the impact on American households? The Fed might again be forced to expand its balance sheet to accommodate this additional spending, a step backward for controlling inflation.

We, at Stephens, rate this Federal Reserve as a significant underdog in winning the war against inflation in a timely fashion. Thus, American households and businesses will suffer. The one silver lining for Americans is that labor markets are unusually healthy as the specter of a recession rises.

The 2022 summer heat will be felt intensely by the Federal Reserve Board and by extension those politicians now trying to manage the problems created by inflation. For months they thought they were dealing with a controllable blaze, but in reality, it’s a wild fire.

About the Expert

Thomas Goho, Ph.D.

Former Chief Economic ConsultantThomas Goho, Ph.D. is formerly the Chief Economic Consultant for Stephens Inc. He also served as the Co-Director of Stephens University at Wake Forest University.

- The information in this newsletter has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. The newsletter is not intended to recommend the purchase or sale of any securities or to provide information on which an investment decision to purchase or sell any securities could be based. Information included in the newsletter was obtained from internal and external sources which we consider reliable, but we have not independently verified such information or independently confirmed that such information is accurate or complete, and we do not represent that such information is accurate or complete. Such information is believed to be accurate on the date of issuance of this newsletter, and any expressions of opinion included in this newsletter apply only on such date of issuance. No subsequent publication or distribution of this newsletter shall mean or imply that any such information or opinion remains current at any time after the stated date of this document. We do not undertake to advise you of any changes in any such information or opinion. Additional information available upon request. © 2022 Stephens Inc. Stephens Inc. is a member of NYSE and SIPC.