Financial Advisor And Fairness Opinion

Pedestal Bancshares, Inc.

M&A Advisory

Has Merged With

Transaction Details

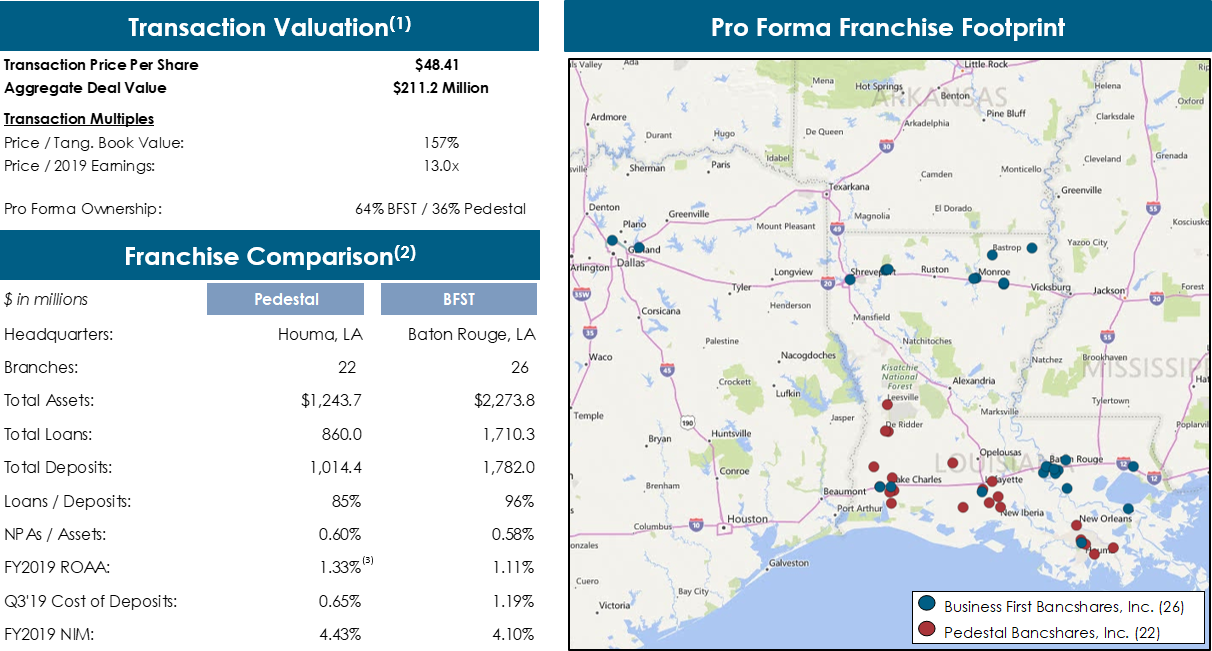

- Pedestal Bancshares, Inc. (“Pedestal”), parent company of Pedestal Bank, and Business First Bancshares, Inc. (“BFST”), the parent company of b1BANK, jointly announced the signing of a definitive merger agreement

- Pedestal shareholders will receive $5.00 in cash and 1.745 shares of BFST common stock per each Pedestal share outstanding

- Pedestal’s shareholders will receive such cash consideration in the form of a pre-closing, tax-free distribution

- Transaction value of approximately $211.2 million in the aggregate, or $48.41 per share

- On pro forma basis, the combined company will have ~$3.5 billion in total assets

- Expected to have #1 deposit market share in Louisiana amongst banks headquartered in the state at closing

- Pro forma ROAA of ~1.5%; pro forma ROATCE of ~15%

- Pedestal Bank’s President and CEO, Mark Folse, will relocate to Baton Rouge to join b1BANK’s executive team

- Pro forma board to have 14 directors, including 4 from Pedestal

- The transaction is expected to close as early as the second quarter of 2020

Sources: Company filings, SNL Financial and publicly available information.

-

(1) Transaction multiples calculated based on the aggregate deal value, Pedestal’s preliminary, unaudited financial results as of or for the twelve months ended December 31, 2019 and BFST’s trailing-20-day VWAP of $24.88 as of January 21, 2020.

(2) Reflects preliminary, unaudited financial results as of or for the twelve months ended December 31, 2019, unless otherwise noted. Pedestal’s NIM and Q3 2019 Deposits Costs are at the bank-level.

(3) Tax-effected at 19.5%.

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the material. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.