Financial Advisor

Triumph Bancorp, Inc.

M&A Advisory

Has Acquired

Southern Colorado Corp.

The Holding Company Of

Transaction Details

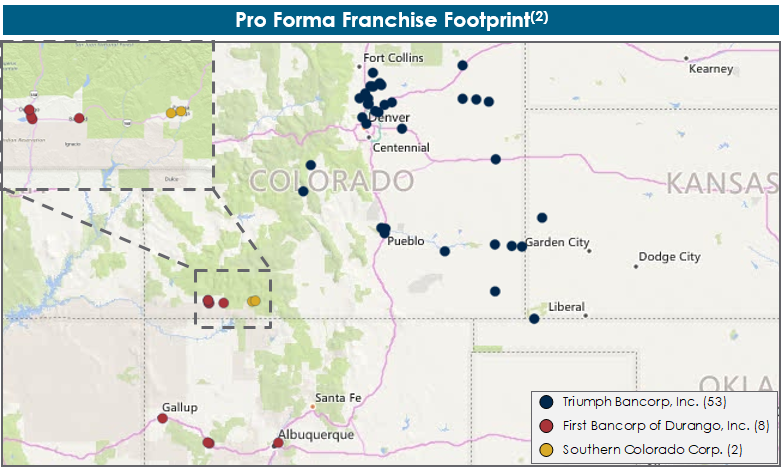

- On April 9, 2018, Triumph Bancorp, Inc. (NASDAQ: TBK)(“Triumph”) announced that it has signed definitive agreements to acquire First Bancorp of Durango, Inc. and Southern Colorado Corp., which combined have $734 million in assets

- As a result of these transactions Triumph’s presence will be among the largest in the state of Colorado, and its market reach will be extended into New Mexico

- Pro forma for the acquisitions, Triumph will have over $1.5 billion in deposits in the state of Colorado

- Provides over $300 million of low cost, excess core deposit liquidity that can be deployed into Triumph’s growing commercial lending and factoring businesses

- 98%(1) core deposits / 47%(1) loan to deposit ratio

- 0.21%(1) average cost of deposits

- Transactions expected to close in 3Q’18

Sources: Company filings, SNL Financial and publicly available information.

-

(1)Combined metrics as of 12/31/2017 for First Bancorp of Durango, Inc. and Southern Colorado Corp.

(2)Map pro forma for Triumph’s announced acquisitions of First Bancorp of Durango, Inc. and Southern Colorado Corp.

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the material. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.