Financial Advisor

Banner Corporation

M&A Advisory

Has Agreed To Acquire

Transaction Details

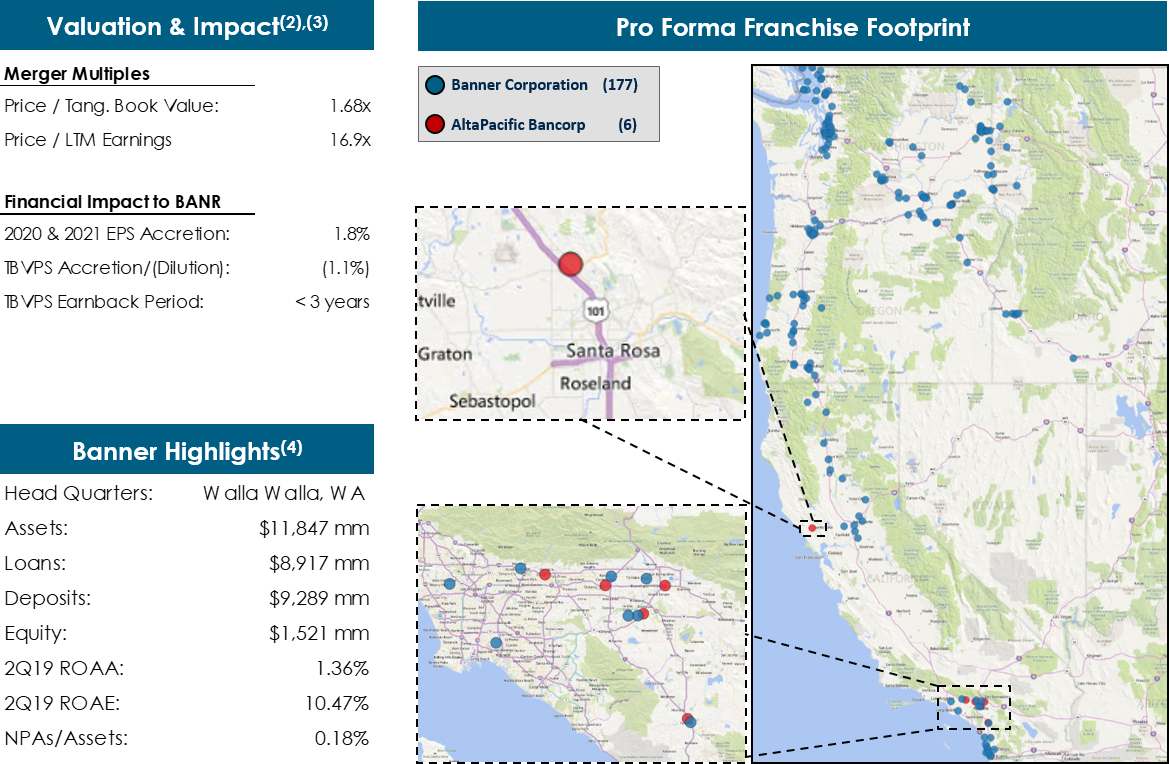

- On July 24, 2019 — Banner Corporation (NASDAQ: BANR) (“Banner”) and AltaPacific Bancorp (OTC Pink: ABNK) (“AltaPacific”) jointly announced the execution of a definitive merger agreement, pursuant to which Banner will acquire AltaPacific and its wholly-owned banking subsidiary, AltaPacific Bank

- In the all-stock merger, AltaPacific shareholders shall receive 0.2712 shares of Banner common stock for each share of AltaPacific stock. Based on Banner’s closing price of $54.19 as of Tuesday, July 23rd, the merger consideration is valued at approximately $87.4 million

- Based on the financial results as of June 30, 2019, the combined company would have pro forma assets of $12.2 billion, deposits of $9.6 billion and loans of $9.3 billion

- The transaction is expected to close in the fourth quarter of 2019(1)

Sources: Company filings, S&P Global Market Intelligence and publicly available information.

-

(1)Subject to regulatory approvals.

(2)All transaction multiples referenced herein per public filings related to the transaction dated July 24, 2019.

(3)Based on BANR’s closing stock price as of July 23, 2019.

(4)Per BANR earnings release dated July 24, 2019.

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the material. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.