Financial Advisor and Fairness Opinion

Community First Bancshares, Inc.

M&A Advisory

Has Merged With

Transaction Details

- Announcement Date: July 14, 2016

- Expected Closing: Q4’2016

- Announced deal value of approximately $69 million

- Transaction consideration consists of 2.69 million shares of Equity common stock and approximately$10.1 million in cash

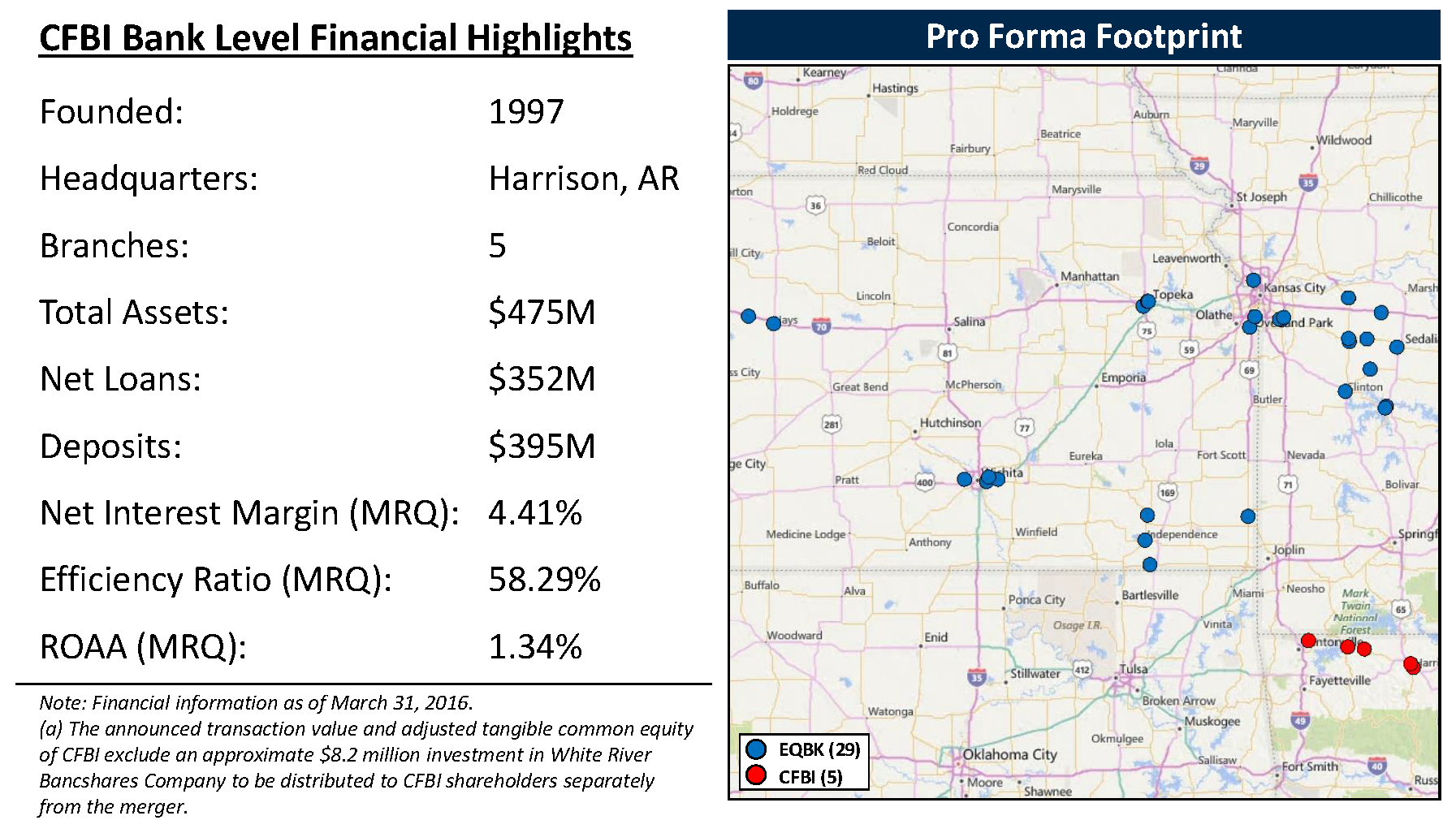

- At the close of the transaction, Equity will be comprised of approximately $2.1 billion in assets and 34 branch offices across its three-state footprint of Arkansas, Kansas and Missouri

- 1.53x price to adjusted tangible book value(a)

- Upon completion of the transaction, EQBK would become the third largest bank headquartered in Kansas based on total assets

Sources: Company filings, SNL Financial and publicly available information.

-

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the material. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.