Financial Advisor And Fairness Opinion

Highlands Bankshares, Inc.

M&A Advisory

Has Merged With

Transaction Details

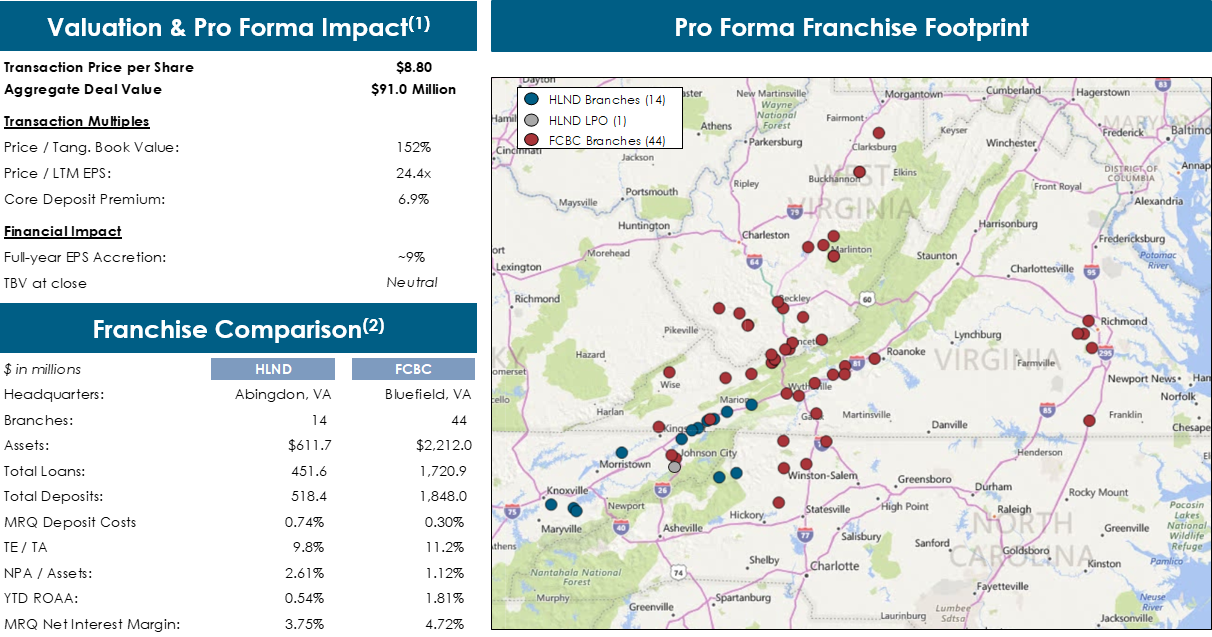

- Abingdon, VA-based Highlands Bankshares, Inc. (“Highlands”), parent company of Highlands Union Bank and Bluefield, VA-based First Community Bankshares, Inc. (“First Community”), parent company of First Community Bank, jointly announced their entry into an agreement and plan of merger

- The combination will bring together two traditional Southwestern Virginia community banks who serve the Highlands region in Virginia, as well as Western North Carolina and East Tennessee

- Upon completion of the transaction, First Community is expected to have total consolidated assets in excess of $2.8 billion

- First Community plans to establish an Advisory Board to maintain a close connection with customers in the Highlands Region

- Each share of Highlands common and preferred stock outstanding immediately prior to the merger will be converted into the right to receive 0.2703 shares of First Community common stock, which equates to $8.80 per share of Highlands common stock and an aggregate transaction value of approximately $91.0 million based on First Community’s recent 20-day average closing price

- The transaction is expected to be consummated in the fourth quarter of 2019

Sources: Company filings, SNL Financial and publicly available information

-

(1) Based on a FCBC’s 20-day average closing price of $32.56 as of September 10, 2019

(2) Reflects Q’2 2019 GAAP financial data for Highlands Bankshares, Inc. and First Community Bankshares, Inc.

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the material. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.