Financial Advisor and Fairness Opinion

Howard Bancorp, Inc.

M&A Advisory

Has Acquired

Transaction Details

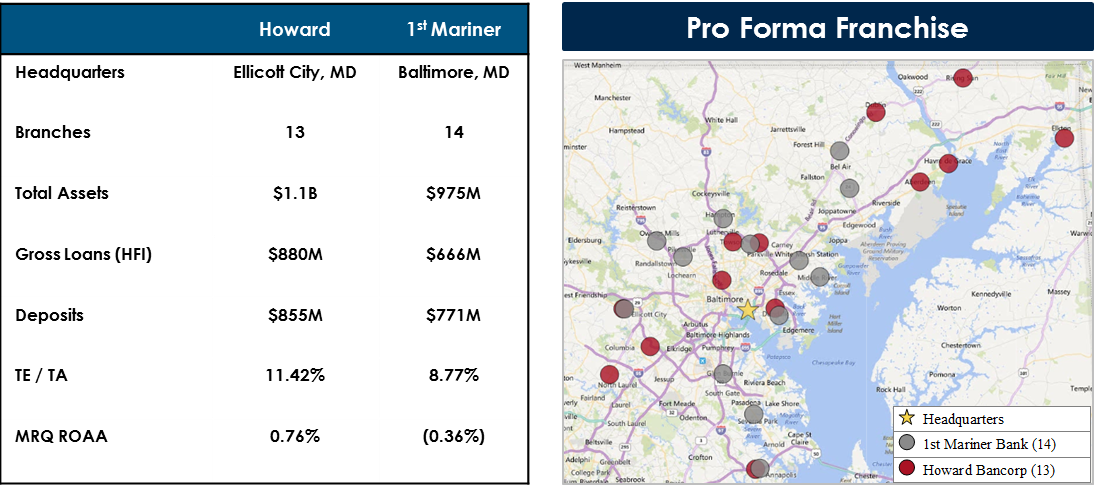

- The combined bank will have assets of approximately $2.1 billion with banking operations in Baltimore, Howard, Anne Arundel, Cecil, and Harford Counties

- Transaction Value: $ 163.4 million

- 100% stock consideration

- 1st Mariner shareholders will receive per share stock consideration of 1.6624 Howard shares

- Options and warrants cashed out at $32.50

- Approximately 48% pro forma ownership for 1st Mariner

- Price / TBV: 1.16x

- 1st Mariner’s CEO will become President of Howard Bancorp and Howard Bank; he will also join the Board of Howard Bancorp

- 14 total board members: 8 Howard / 6 1st Mariner

- Expected Closing: Q4 2017

Sources: Company filings, SNL Financial and publicly available information.

-

Note: Financial information as of or for the period ended June 30, 2017. Market data as of August 14, 2017.

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the material. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. The publicly filed investor presentation can be found by clicking here. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.