Financial Advisor and Fairness Opinion

Liberty Financial Services, Inc.

M&A Advisory

Liberty Financial Services, Inc.

The Parent Company Of

Has Merged With And Into

215 Holding Co.

The Parent Company Of

Transaction Details

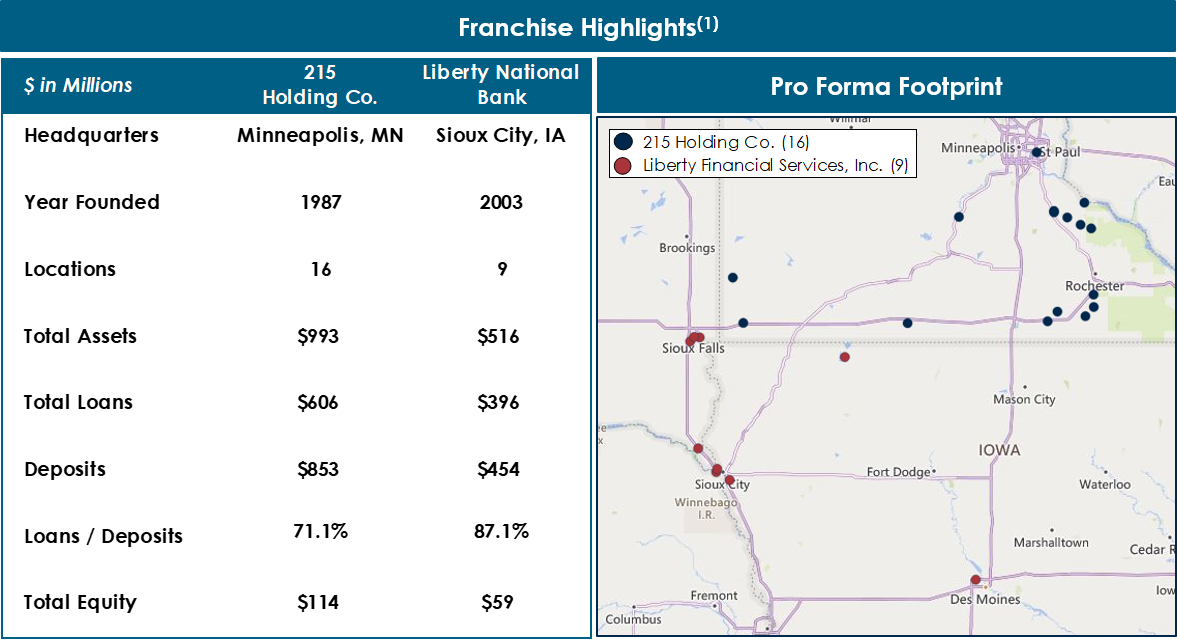

- On April 21, 2022, 215 Holding Co. (“215”), the parent company of First Farmers & Merchants Bank (“FFMB”), and Liberty Financial Services, Inc. (“Liberty”), the parent company of Liberty National Bank, signed a definitive agreement providing for the merger of Liberty with and into 215.

- On a pro forma basis, based on December 31, 2021 results, the combined company will have total assets of approximately $1.5 billion with $1.0 billion in loans and $1.3 billion in deposits, with full-service banking locations in Central, Southern and Southwestern Minnesota, Northwestern and Southwestern Iowa and Southeastern South Dakota.

- The transaction is expected to close mid-year 2022.

- Subsequent to the merger, Liberty National Bank will become a wholly owned subsidiary of 215 and 215 will continue to operate each of Liberty National Bank and FFMB under separate, stand-alone charters.

Sources: Company Documents, S&P Global Market Intelligence and publicly available information.

-

(1) 215 Holding Co. financials based on BHC-regulatory data and Liberty Financial Services, Inc. financials based on bank-level regulatory data as of 12/31/2021.

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.

-

“Stephens” (the company brand name) is a leading family-owned independent financial services firm. Stephens’ US operations are headquartered in Little Rock, AR, with strategic locations in the US and a European presence in the UK and Germany. Stephens Inc. is a Member of the New York Stock Exchange and the Securities Investor Protection Corporation and is regulated by the United States Securities and Exchange Commission and the Financial Industry Regulatory Authority. Stephens Europe Limited (Registered office: 12 Arthur Street, London, EC4R 9AB, Registered number 8817024) is authorised and regulated by the Financial Conduct Authority. For more information, visit www.stephens.com. © 2022 Stephens