Financial Advisor And Fairness Opinion

Rush-Oak Corporation

M&A Advisory

Has Merged With

Transaction Details

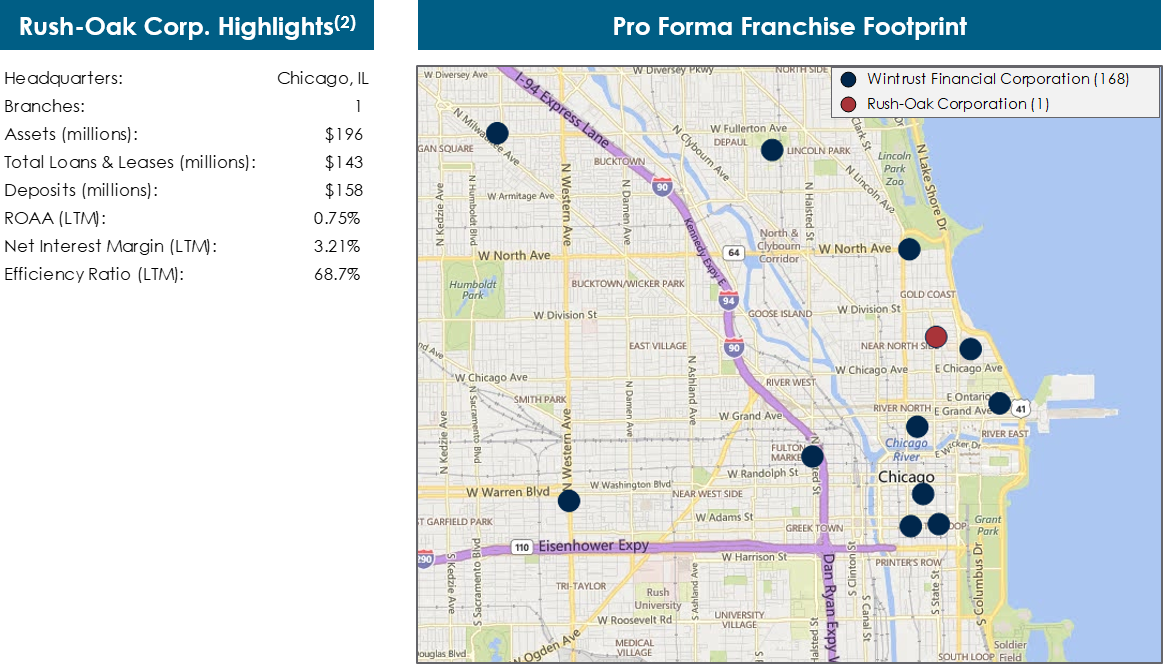

- On February 20, 2019 — Rosemont, IL-based Wintrust Financial Corporation (“Wintrust”) (NASDAQ: WTFC) announced the signing of a definitive agreement to acquire Rush-Oak Corporation (“ROC”)

- Subject to possible adjustment, the aggregate purchase price to ROC shareholders is currently estimated to be approximately $46 million. Shares of ROC common stock outstanding at the time of the merger will be converted into the right to receive per share merger consideration to be paid in cash

- The merger agreement also provides that, prior to closing, the shares of Oak Bank held directly by individual minority shareholders will be redeemed for cash by ROC for an aggregate redemption value of approximately $9 million, leaving Oak Bank as a wholly-owned subsidiary of ROC

- The transaction provides Wintrust with the opportunity to expand its market presence in the heart of the City of Chicago

- The merger is expected to be completed in 2Q’19(1)

Sources: Company filings and S&P Global Market Intelligence.

-

(1) Subject to approval by bank regulatory authorities and the shareholders of Rush-Oak Corporation.

(2) Rush-Oak Corporation highlights based on bank-level data as of December 31, 2018.

-

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the material. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.