Financial Advisor

Simmons First National Corporation

M&A Advisory

Has Acquired

Transaction Details

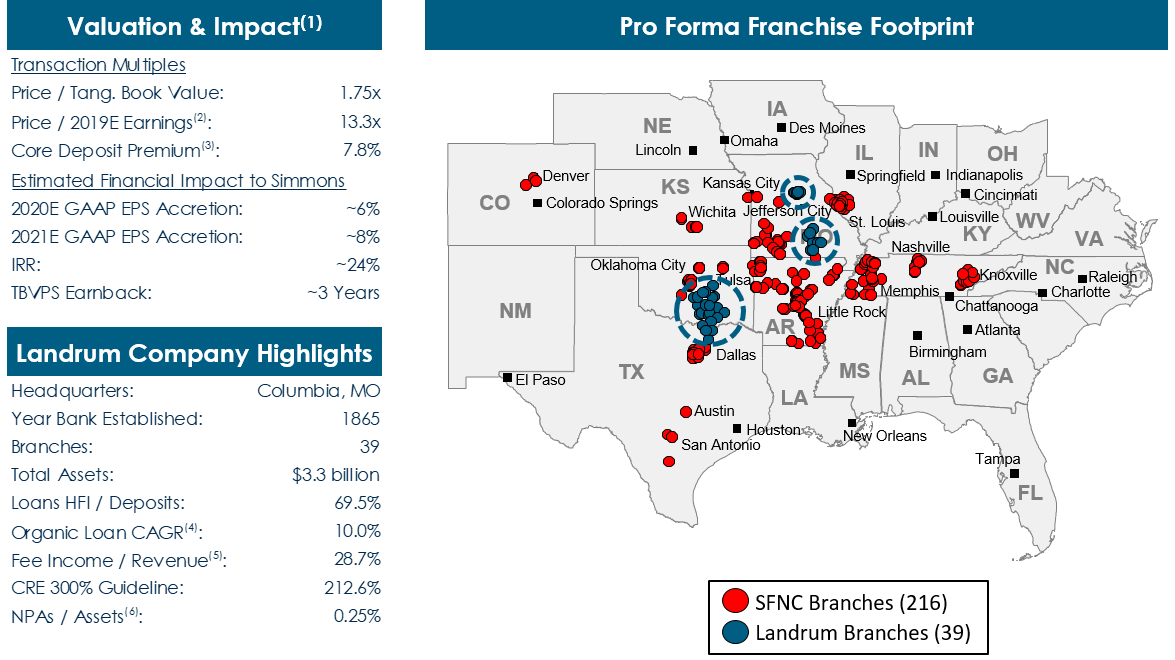

- Simmons First National Corporation (Nasdaq: SFNC) (“Simmons”) announced that it has entered into a definitive agreement and plan of merger with The Landrum Company (“Landrum”) to acquire all of the outstanding capital stock of Landrum in an all-stock transaction

- Landrum is headquartered in Columbia, Missouri, and is the parent company of Landmark Bank

- Landrum’s common stockholders will receive, in the aggregate, 17,350,000 shares of Simmons’ common stock, valued at approximately $433.9 million, based on the closing share price of Simmons of $25.01 on July 29, 2019

- Pro forma the transaction, Simmons will have approximately $21.4 billion in assets, making it the 53rd largest U.S. bank

- Completion of the transaction is expected during the fourth quarter of 2019

Sources: Company press release and investor presentation, S&P Global Market Intelligence and publicly available information.

-

(1) Based on a SFNC closing price of $25.01 on July 29, 2019.

(2) Based on Landrum’s estimated earnings of $32.7 million for 2019E.

(3) Core deposits calculated as total deposits less jumbo time deposits > $250,000 and brokered deposits.

(4) Since 2013. Excludes loans held for sale.

(5) For the quarter ended 6/30/19.

(6) Excluding restructured loans.

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the material. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.