Financial Advisor And Fairness Opinion

State Capital Corp.

M&A Advisory

Has Merged With

Transaction Details

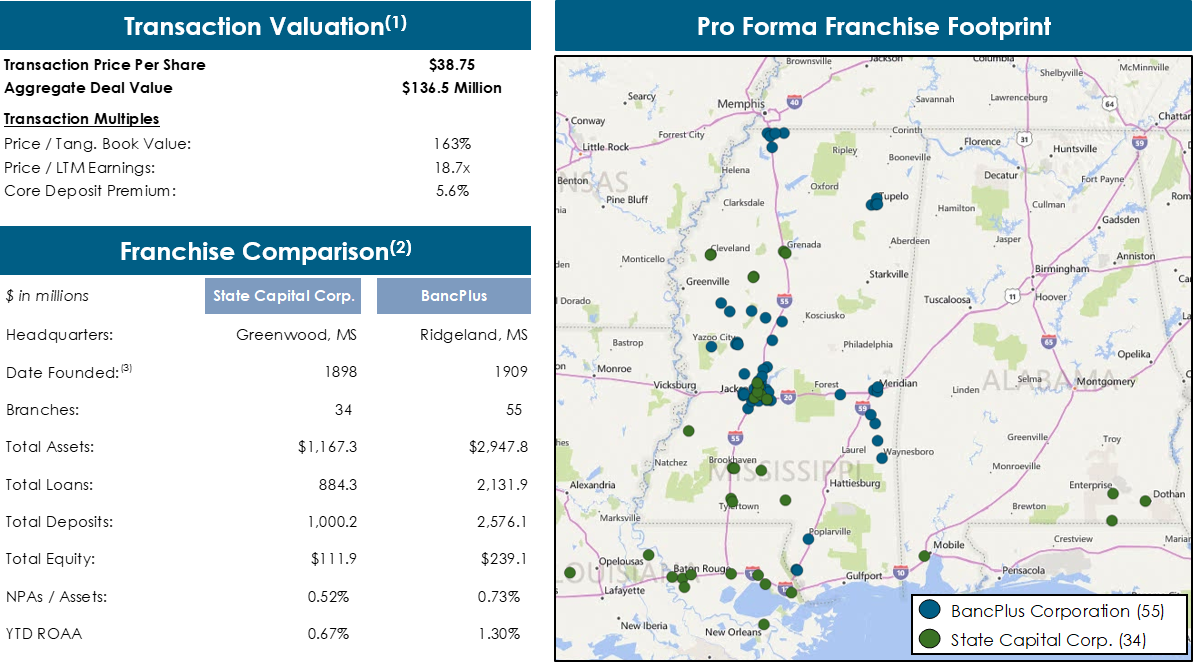

- State Capital Corp. (“State Capital”), parent company of State Bank and Trust Company, announced today the signing of a definitive merger agreement with BancPlus Corporation (“BancPlus”), the parent company of BankPlus

- Combination between two of Mississippi’s oldest banks

- Combined company will have approximately $4.2 billion in assets and rank as the 6th largest bank by deposits in the state of Mississippi

- Transaction expands BankPlus’ footprint into Louisiana and Alabama

- Kirk Graves, Chief Executive Officer of State Bank, will join the senior executive management team of BankPlus upon completion of the merger

- State Capital shareholders will receive shares of BancPlus’ common stock for each outstanding share of State Capital common stock. The transaction is valued at approximately $136.5 million in the aggregate, or $38.75 per share

- Merger is expected to close in the first quarter of 2020

Sources: Company filings, SNL Financial and publicly available information.

-

(1) Transaction multiples calculated based on the aggregate deal value and financial results as of or for the twelve months ended June 30, 2019.

(2) Reflects Q’2 2019 FR Y-9C financial data for State Capital Corp. and BancPlus Corporation.

(3) Bank-level.

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the material. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.