Fairness Opinion

Heartland Financial USA, Inc.

M&A Advisory

Has Acquired

Transaction Details

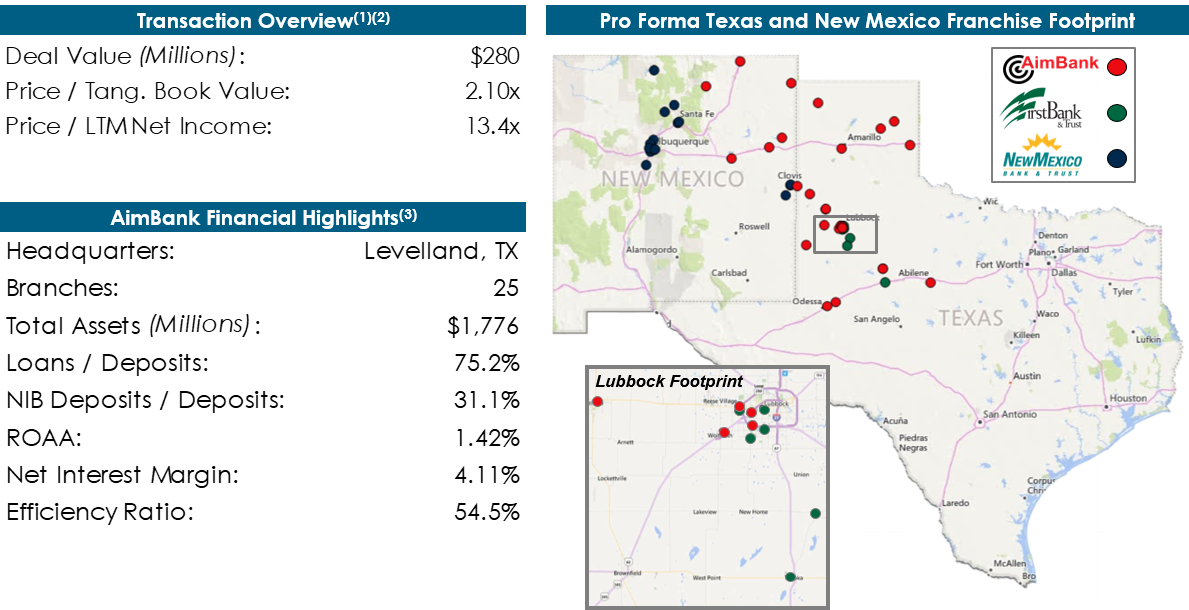

- On February 11th, 2020, Heartland Financial USA, Inc. (“Heartland”)(NASDAQ: HTLF), the sole shareholder of FirstBank & Trust and New Mexico Bank & Trust, announced it will acquire AIM Bancshares, Inc. (“AIM”) and its wholly owned subsidiary, AimBank

- Upon completion of the merger of AIM with and into Heartland, AimBank will merge with and into FirstBank & Trust, Heartland’s existing Lubbock, Texas based subsidiary

- AimBank operates 25 full-service banking centers serving the West Texas and Northeastern New Mexico markets

- The combination of AimBank and FirstBank & Trust will create Heartland’s largest bank subsidiary with assets of almost $3 billion and 33 banking centers serving West Texas and Northeastern New Mexico

- After completing the acquisition of AIM, Heartland will have total assets of approximately $15 billion with 140 full-service banking locations operating in 12 states

- The transaction has been unanimously approved by the boards of directors of both companies and is expected to close in the third quarter of 2020

Sources: Heartland issued press release and S&P Global Market Intelligence

-

1) Based on HTLF stock price of $49.88 as of February 10, 2020

2) Reflects AIM Bancshares consolidated financials as of and for the last 12 months ended December 31, 2019

3) Reflects bank - level call report data as of and for the last 12 months ended December 31, 2019

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the material. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.