Advisor & Fairness Opinion

Capital Bancorp, Inc.

M&A Advisory

Has Agreed To Acquire

Transaction Details

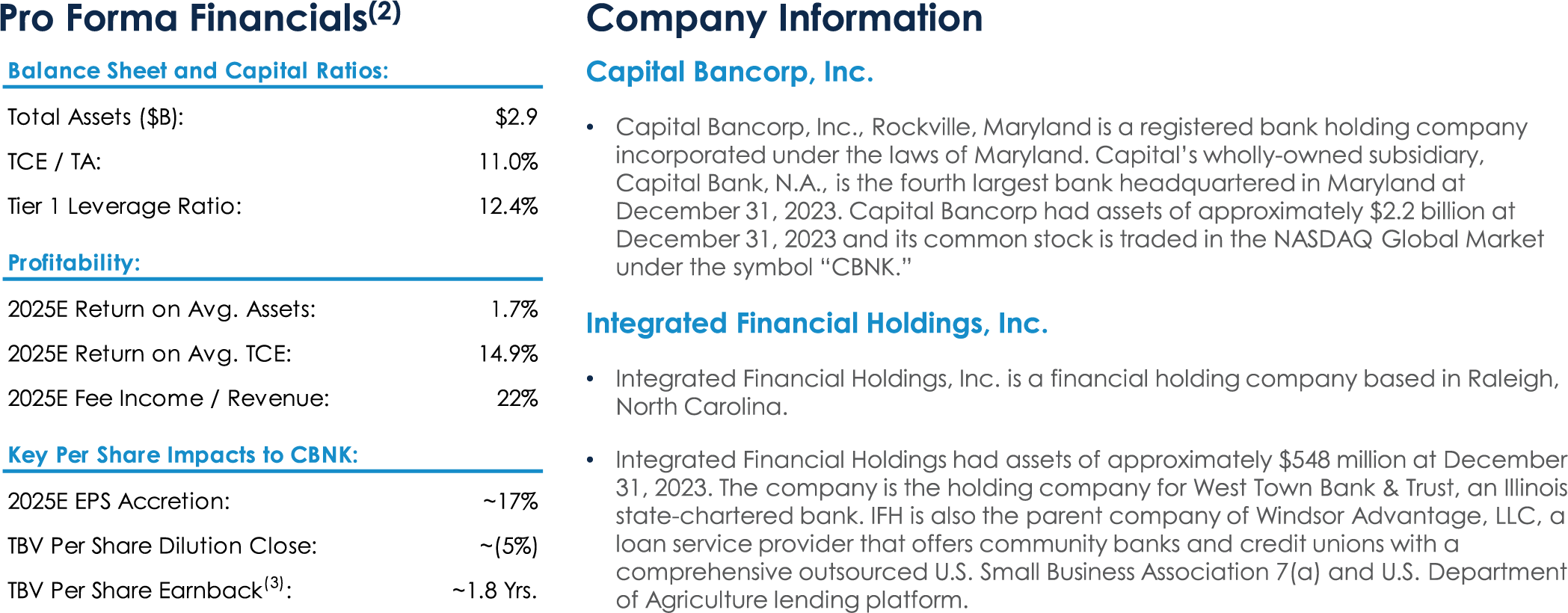

- On March 28, 2024, Capital Bancorp, Inc. ("CBNK” or “Capital") (NASDAQ: CBNK) and Integrated Financial Holdings, Inc. (“IFH”) (OTCQX: IFHI) announced that they have entered into a definitive merger agreement under which CBNK will acquire IFH in a cash and stock transaction valued at $66 million(1) .

- Under the terms of the merger agreement, IFH shareholders will, subject to certain adjustments, receive $5.36 in cash and 1.115 shares of CBNK common stock for each share of IFH common stock.

- At or immediately prior to the closing, IFH is expected to distribute its minority equity interest in Dogwood State Bank to IFH shareholders in the form of a dividend equal to approximately 0.469 shares of Dogwood State Bank for each share of IFH common stock, a value of $7.69/share or approximately $18 million based on the closing price of Dogwood State Bank on March 26, 2024.

- This transaction adds another high-return vertical to Capital’s business model, further complementing its existing set of commercial and consumer businesses and contributing to a highly diversified and differentiated earnings mix across various local, regional and national businesses.

- The transaction will create a best-in-class nationwide lender in government guaranteed lending across both U.S. Department of Agriculture (“USDA”) and U.S. Small Business Association (“SBA”) government guaranteed lending.

Sources: Company Press Release, Company Investor Presentation, and S&P Global Market Intelligence.

-

(1) Based on CBNK closing price of $20.00 as of March 26, 2024. Exclusive of the value of a dividend to be received by IFH shareholders at or immediately prior to closing.

(2) Pro forma financials for the combined company as of estimated transaction closing date and include the impact of purchase accounting adjustments and other merger related adjustments.

(3) Crossover method used.This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.

"Stephens” (the company brand name) is a leading family-owned investment firm that includes Stephens Inc. (member NYSE/SIPC), Stephens Investment Management Group, LLC, Stephens Insurance, LLC, Stephens Capital Partners LLC and Stephens Europe Limited (Registered office: 12 Arthur Street, London, EC4R 9AB, Registered number 8817024), which is authorised and regulated by the Financial Conduct Authority. © 2024 Stephens.

For more information, visit www.stephens.com. © 2024 Stephens

For a printable version of this announcement, click here.