Financial Advisor

Simmons First National Corporation

M&A Advisory

Has Acquired

Transaction Details

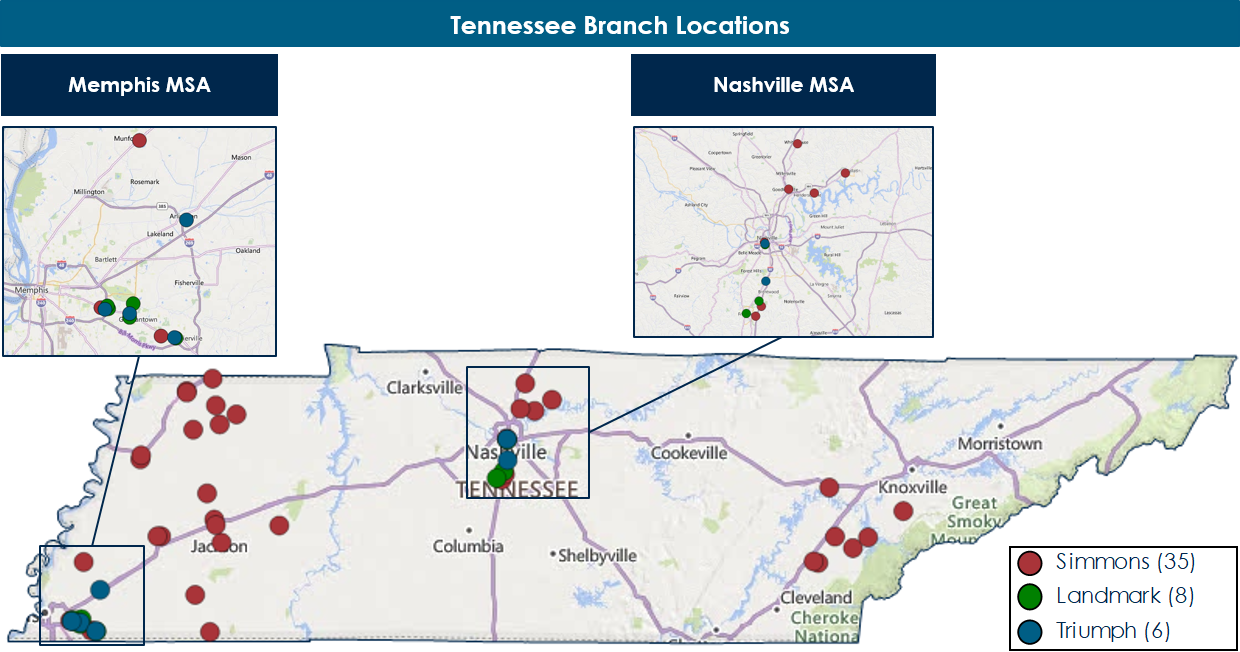

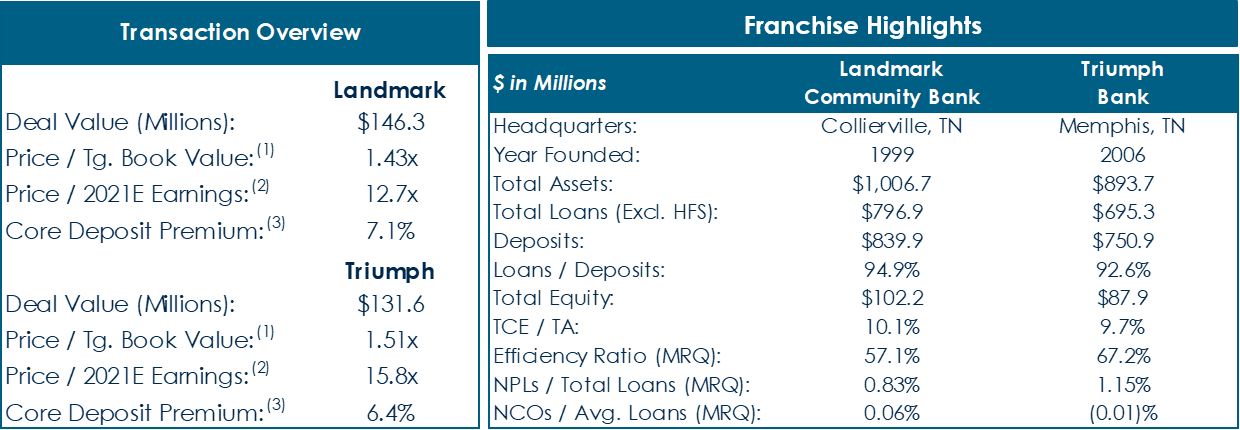

- On June 7, 2021, Simmons First National Corporation (“Simmons”), announced it has entered into two separate definitive agreements to acquire Landmark Community Bank (“Landmark”) and Triumph Bancshares, Inc., the holding company of Triumph Bank (collectively “Triumph”)

- On a pro forma basis, the proposed Landmark and Triumph transactions will create the 9th largest bank in Tennessee (based upon deposit market share) while improving Simmons’ ranking in Memphis from 35th to 6th and in Nashville from 20th to 15th

- The proposed transactions are expected to close in the fourth quarter of 2021

Sources: Company Documents, S&P Global Market Intelligence and publicly available information.

-

Note: Pricing data based on Simmons’ closing price of $30.96 as of 6/4/21. Reflects financial data as of 3/31/21.

(1) Based on 3/31/21 tangible book value.

(2) 2021E earnings based on annualized 1Q21 net income.

(3) Core deposits calculated as total deposits less jumbo time deposits > $250,000 and brokered deposits.

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.

“Stephens” is the brand name for a family of independent privately held financial services firms, including Stephens Europe Limited, which is authorized and regulated by the Financial Conduct Authority (Registered office 12 Arthur Street, London, EC4R 9AB, Registered number 8817024) and Stephens Inc. which is regulated by the United States Securities and Exchange Commission and the Financial Industry Regulatory Authority (Home Office: 111 Center Street, Little Rock, AR USA, 501-377-2000). Stephens Inc. is a member of NYSE and SIPC. For more information, visit www.stephens.com. © 2021 Stephens