Financial Advisor and Fairness Opinion

Spirit of Texas Bancshares, Inc.

M&A Advisory

Has Acquired

Transaction Details

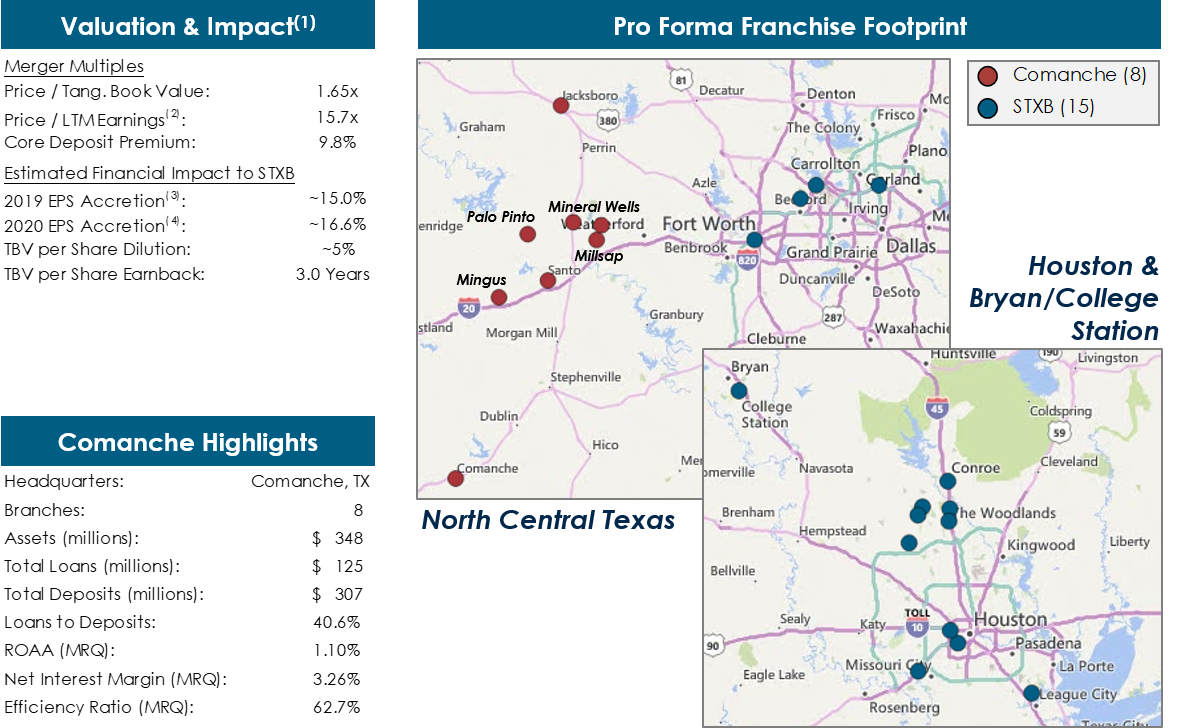

- July 19, 2018 – Spirit of Texas Bancshares, Inc. (NASDAQ: STXB), the holding company for Spirit of Texas Bank, SSB, today announced that it has entered into a definitive agreement to acquire Comanche National Corporation and its subsidiary, Comanche National Bank.

- The transaction is valued at approximately $55.9 million, approximately 78% stock / 22% cash, based on STXB’s closing common stock price of $20.36 per share on July 18, 2018

- Comanche brings an attractive core deposit base and low loan to deposit ratio:

- Comanche has a loan to deposit ratio of approximately 40% as of June 30, 2018, with over $180 million in excess deposits

- Reduces pro forma STXB loan to deposit ratio from 105.4% to 88.1%

- STXB effectively utilizes proceeds from May 3, 2018 IPO for a financially attractive transaction:

- Immediate double digit earnings per share accretion

- Adds significant scale and increases opportunity for enhanced efficiencies and profitability

- Additional IPO proceeds available for future acquisitions

Sources: Company filings, SNL Financial and publicly available information

-

Note: Reflects bank level financial data as of the most recent quarter available

(1) Based on a STXB closing price of $20.36 on July 18, 2018, and estimated seller transaction costs of $2.8 million

(2) LTM reflects adjustment for one-time DTA revaluation associated with tax legislation of $266 thousand

(3) Assumes a transaction close of 12/31/18 and 75% noninterest expense cost savings realization for the full year

(4) First full year

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the material. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.