Financial Advisor and Fairness Opinion

Equity Bancshares, Inc.

M&A Advisory

Has Acquired

Transaction Details

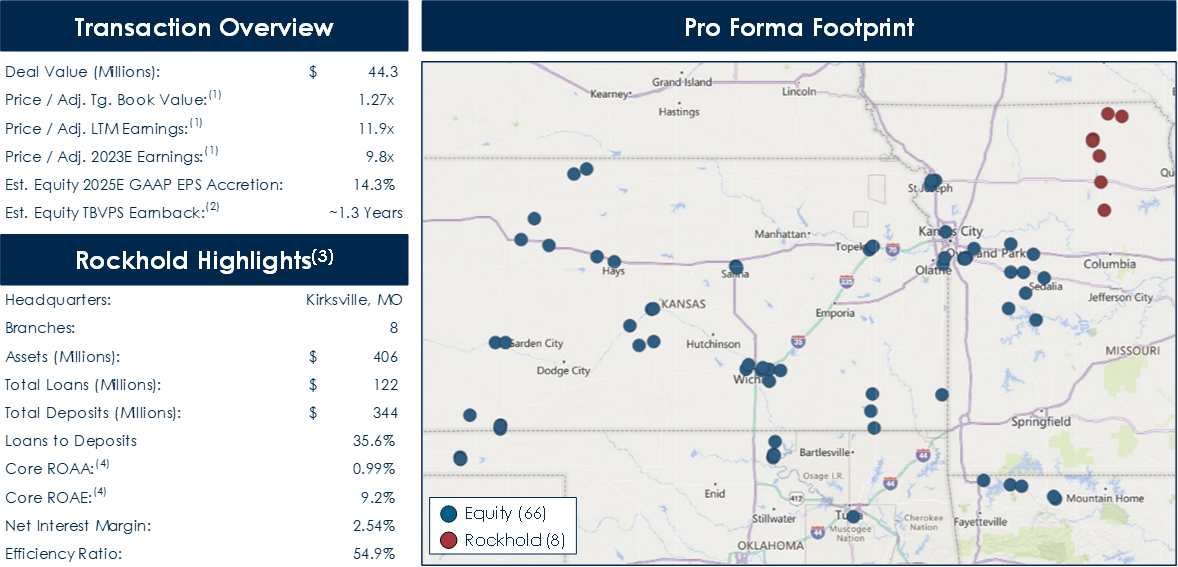

- On December 6, 2023, Equity Bancshares, Inc. (“Equity”) announced the signing of a definitive merger agreement with Rockhold BanCorp. (“Rockhold”), the parent company of Bank of Kirksville

- Under the terms of the merger agreement, Equity will pay $44.3 million in cash consideration and Rockhold will pay a pre-closing one-time special cash dividend of $17.8 million, subject to adjustment and contingent on delivery of $34.2 million of minimum tangible common equity at close (net of one-time merger expenses and one-time special cash dividend)

- The acquisition will increase the number of Equity locations to 74 with entry into north central Missouri

- After completion of the transaction, Equity will have approximately $5.4 billion in total assets

- The transaction is expected to close in the 1st quarter of 2024

Sources: Company Documents, S&P Global Market Intelligence and publicly available information.

-

(1) Rockhold tangible book value is consolidated and as of September 30, 2023 and adjusted to exclude one-time special cash dividend of $17.8 million. Rockhold earnings taxed at 22.5% due to S-Corp status and adjusted to exclude pre-tax cash yield of 5.00% on one-time special cash dividend of $17.8 million.

(2) TBVPS Earnback is calculated using the cross-over method.

(3) Reflects Rockhold bank-level regulatory financials at or for the last twelve months ended September 30, 2023.

(4) Taxed at 22.5% due to S-Corp status.This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.

“Stephens” (the company brand name) is a leading family-owned investment firm that includes Stephens Inc. (member NYSE/SIPC), Stephens Investment Management Group, LLC, Stephens Insurance, LLC, Stephens Capital Partners LLC and Stephens Europe Limited (Registered office: 12 Arthur Street, London, EC4R 9AB, Registered number 8817024), which is authorised and regulated by the Financial Conduct Authority.

For more information, visit www.stephens.com. © 2023 Stephens

For a printable version of this announcement, click here.