Financial Advisor and Fairness Opinion

Equity Bancshares, Inc.

M&A Advisory

Has Acquired

Cache Holdings, Inc.

The Holding Company Of

Transaction Details

- Announcement Date: July 17, 2017

- Expected Closing: 4Q’17

- Deal Value: $50.5 million

- Total consideration to consist of approximately 73% stock / 27% cash

- Under the terms of the agreement, Cache shareholders will receive 53.000 shares of EQBK common stock and $615.12 in cash for each share of Cache common stock

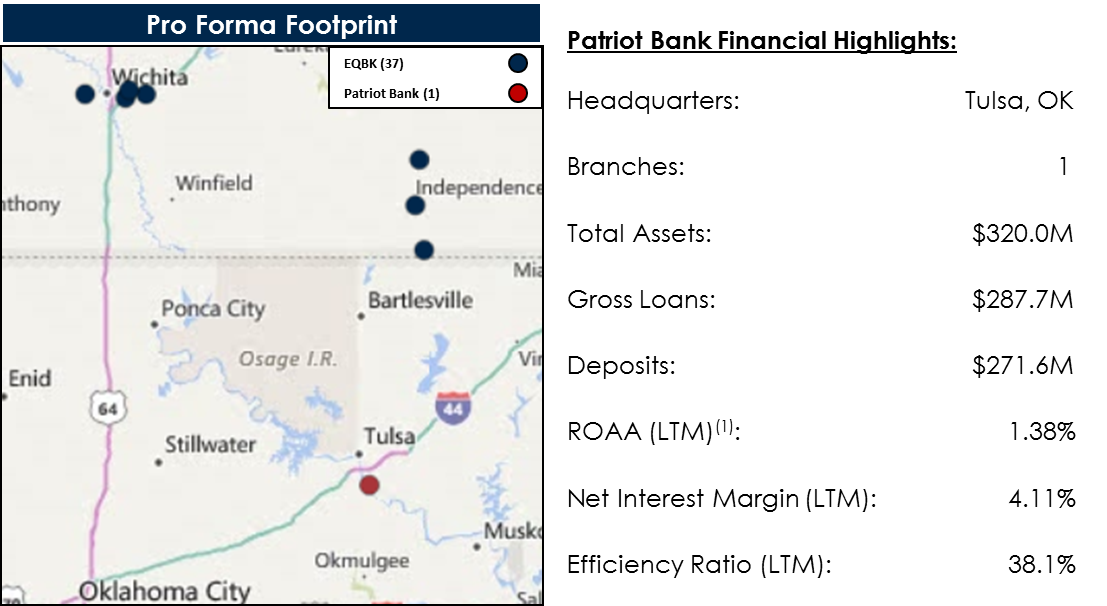

- The pro forma company will be ranked 20th in deposit market share in the Tulsa MSA

- 12.6x price / LTM earnings (3/31/17)(1)

- 176% price / tangible book value (3/31/17)

Sources: Company filings, SNL Financial and publicly available information.

-

Note: Financial information is based on bank-level data and is as of March 31, 2017. Deposit market share data is as of June 30, 2016. Deal value includes stock consideration for stock options.

(1) LTM earnings adjusted for tax impact. ROAA adjusted for Company’s S-Corp status and tax-effected at 39.0%.

This material has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the material was obtained from sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. No subsequent publication or distribution of this material shall mean or imply that any such information or opinion remains current at any time after the stated date of the material. We do not undertake to advise you of any changes in any such information or opinion. Additional information is available upon request.

All data from SNL copyright © 2017, S&P Global Market Intelligence. S&P Global Market Intelligence and its affiliates (together “S&P Global”) do not guarantee the accuracy, adequacy, completeness or availability of any content provided and are not responsible for any errors or omissions, regardless of the cause or for the results obtained from the use of such content. In no event shall S&P Global be liable for any damages, costs, expenses, legal fees, or losses in connection with any use of S&P Global content.