Financial Advisor

LINKBANCORP, Inc.

M&A Advisory

Has Agreed To Sell Three Branches To

Transaction Details

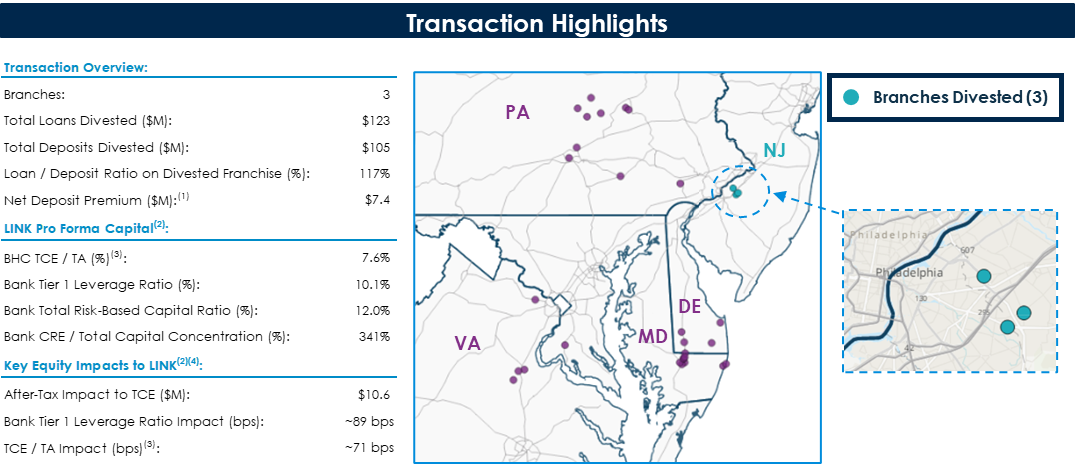

- On May 9, 2024, LINKBANCORP, Inc. (“LINK”) (NASDAQ: LNKB) announced that its wholly owned subsidiary, LINKBANK, entered into a definite purchase and assumption agreement under which American Heritage Federal Credit Union, based in Philadelphia, Pennsylvania, will acquire LINKBANK’s banking operations and 3 branches in New Jersey

- The transaction includes approximately $105 million of deposits and $123 million in loans

- The transaction is subject to customary closing conditions, including regulatory approvals, and is expected to close in the second half of 2024

- 100% cash consideration paid to LINK

- $7.4 million deposit premium paid(1) to LINK

Sources: Company Press Release, Company Investor Presentation, S&P Global Market Intelligence.

-

(1) Deposit premium is set at 7.0% of deposits acquired at closing.

(2) Financial data as of 3/31/2024.

(3) Non-GAPP financial measure.

(4) After-tax financial impacts assume 21.0% tax rate.This material has been prepared solely for informational purposes as of its stated date. It is not a solicitation, recommendation or offer to buy or sell any security and does not provide information on which an investment decision to purchase or sell any securities could be based. It does not purport to be a complete description of the securities, markets or developments referred to in this material. All information and data included in this material has been sourced from company announcements and other sources cited in this material, but Stephens has not independently verified such information and does not guarantee that it is accurate or complete. No subsequent publication or distribution of this material shall mean or imply that any such information remains current at any time after the date of preparation of this material. Stephens does not undertake to advise you of any changes in any such information. Additional information is available upon request.

“Stephens” (the company brand name) is a leading family-owned investment firm that includes Stephens Inc. (member NYSE/SIPC), Stephens Investment Management Group, LLC, Stephens Insurance, LLC, Stephens Capital Partners LLC and Stephens Europe Limited (Registered office: 12 Arthur Street, London, EC4R 9AB, Registered number 8817024), which is authorised and regulated by the Financial Conduct Authority. © 2024 Stephens